In addition to broad relief measures, the latest pandemic relief bill (the American Rescue Plan of 2021) includes several significant tax changes. The House passed the bill Wednesday, after passing the Senate late last week. The President is expected to sign the roughly $1.9 trillion bill into law later this week.

More relief for individuals and areas impacted by the pandemic

The bill includes direct relief for households through $1,400 payments for eligible individuals, including dependents. For example, a family of four meeting the requirements would receive a payment of $5,600. Income phaseouts apply for individuals with income higher than $75,000 and $150,000 for married couples filing a joint return. The bill provides for a full phaseout of payments at $80,000 and $160,000 respectively.

Also included is relief for state and local governments, schools, and health-care related funding such as vaccine distribution, nutrition assistance, and relief for affected industries.

Enhanced federal unemployment benefits, due to expire next week, are extended, including an extra $300 weekly federal benefit, in addition to state benefits, through September 6, 2021.

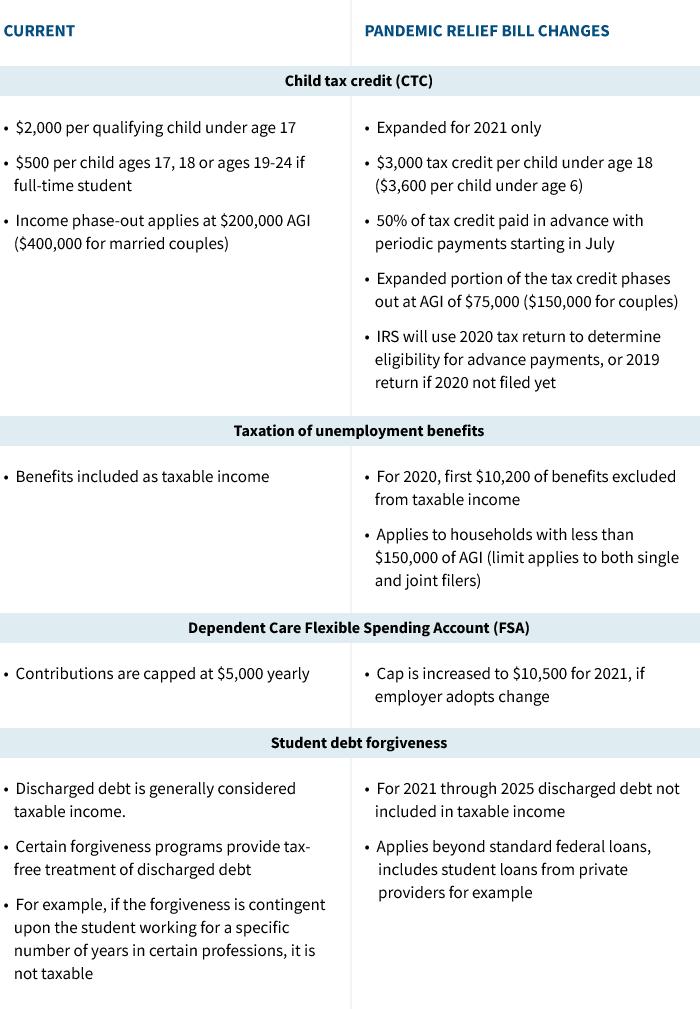

Tax changes included in the relief bill

Health-care benefits increased

Premium subsidies offered under the Affordable Care Act (ACA) are expanded for 2021 and 2022. Currently, subsidies to purchase health insurance through ACA exchanges are limited to those reporting income less than 400% of the federal poverty limit (FPL). The new bill includes a provision that ties ACA premium subsidies to current income – those earning more than 400% of the FPL will pay no more than 8.5% of their income on healthcare insurance offered through exchanges. Additionally, the bill covers 100% of the cost of COBRA health insurance premiums through the end of September to ensure laid-off workers can remain on their employer plans.

Planning considerations

Taxpayers may want to consider steps to reduce income if it will improve eligibility for tax benefits such as the enhanced Child Tax Credit (CTC) for 2021. Also, if using a flexible spending account (FSA) to cover qualified dependent care expenses, such as daycare with pre-tax funds, check with your employer. Once the bill is signed employees may be able to increase their contributions this year. Given the expansion of ACA premium subsidies for 2021 and 2022, it might make sense to review current health insurance to determine if obtaining coverage through the ACA exchanges would be less costly.

325260

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.