Portfolio insights from our experts

Putnam's Portfolio Solutions Group can help you be more proactive analyzing clients' investment portfolios.

Contact your Putnam consultant now

Our consultants are ready to assist you

The Portfolio Solutions Group can provide institutional-level risk analysis to identify the risk factors that drive portfolio performance, explain portfolio risk factors, and discuss potential alternative portfolios on client request.

Putnam's Portfolio Solutions Group consists of seven investment professionals experienced in asset allocation and risk management. They are ready to assist you with analyzing client portfolios.

Do you advise retirement plans?

Putnam can customize reports for target-date funds, to shed light on glide path design and security selection strategies.

Putnam can help you identify risks

Portfolios have grown more complex and can include thousands of securities, multiple asset classes, and unique investment strategies. Understanding what forces will drive performance and locating the risks can be challenging.

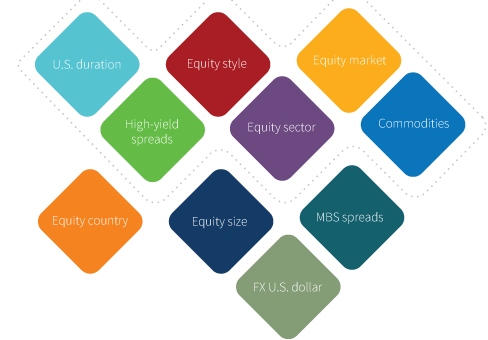

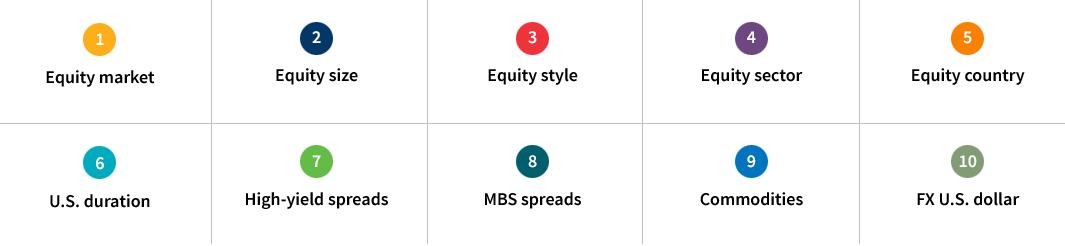

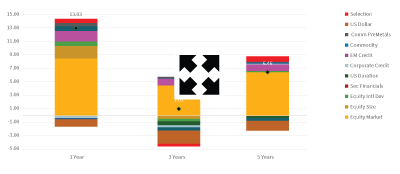

Members of Putnam's Portfolio Solutions Group can help you identify and track dozens of investment risk factors and will seek to determine which ones have the greatest impact on a specific portfolio. The illustration below shows some of the most important risks that might be of primary concern to you.

Examples of risk factors that can be analyzed

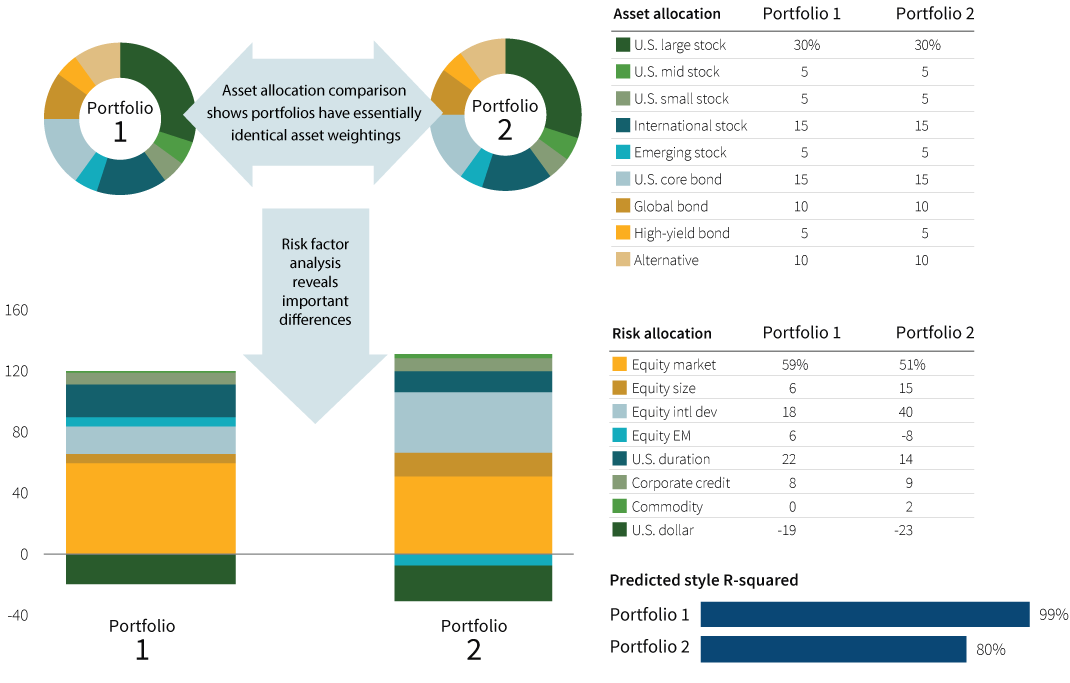

Example of a portfolio comparison

Putnam's analysis can show you how the distribution of risks in a portfolio might be different than expected based on a portfolio's asset allocation. Below you can see a comparison of two portfolios that have a similar asset allocation but are different when it comes to the risk factors that drive performance.

A hypothetical comparison of two portfolios' drivers of risk and return

You can request a customized report

The service begins with a consultation about current portfolio choices and allocations. The Putnam team then requests information on the specific portfolio to initiate the review.

Below are some of the key highlights of a customized report:

Risk breakdown |

Risk impact |

Risk budgeting |

Scenario analysis |

Strategy framework |

|---|---|---|---|---|

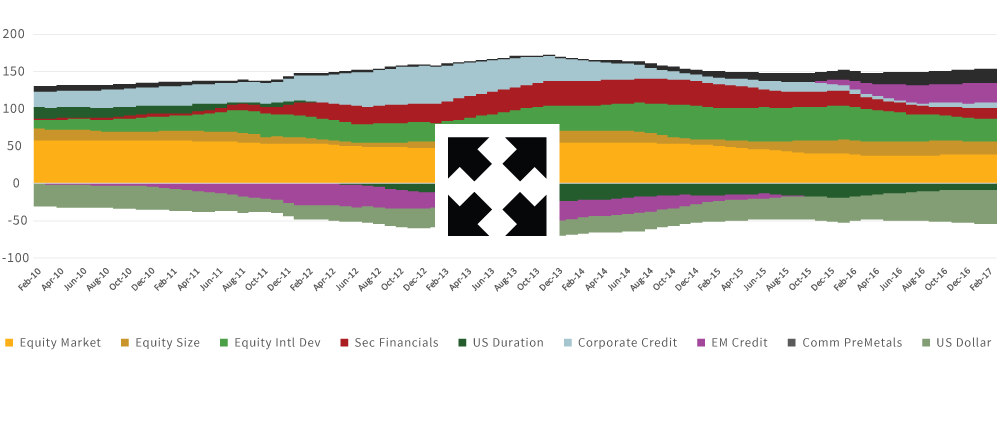

Risk breakdown: Risk factors over time

|

Risk impact: Contributions to returns over multiple periods

|

Risk budgeting: Allocations at strategy and risk factor levels

|

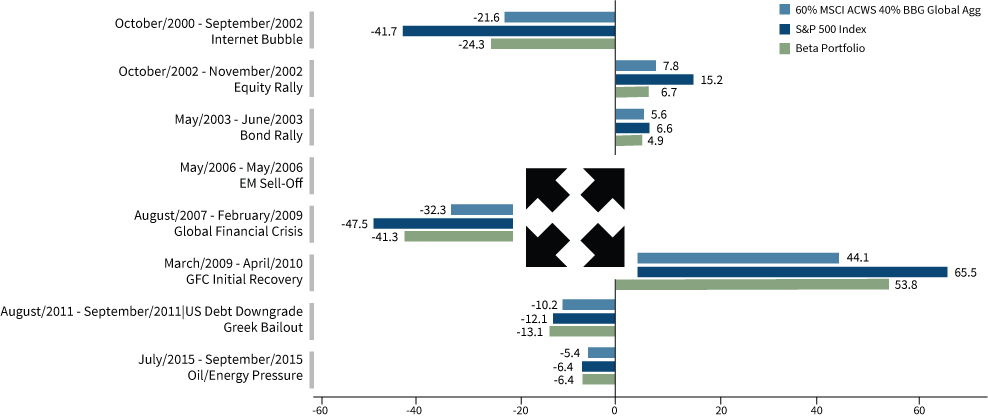

Scenario Analysis: Stress tests in past bull and bear markets

|

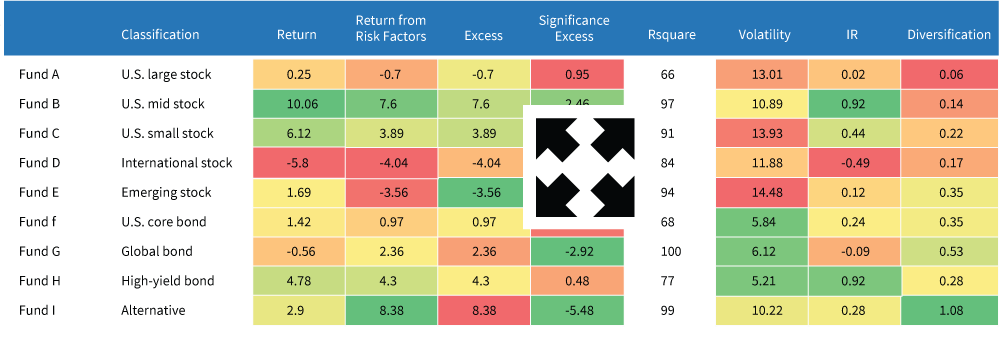

Strategy framework: Data for building portfolio diversification

|

|

Risk factors over time |

Contributions to returns over multiple periods |

Allocations at strategy and risk factor levels |

Stress tests in past bull and bear markets |

Data for building portfolio diversification |

The service offers several benefits

Better understand historical portfolio performance

Use this risk factor approach to provide insight and quantify why a portfolio performed a specific way

Confirm a portfolio is appropriately positioned

Align portfolio positioning based on current market views, and identify managers to best achieve intended exposures

Set expectations based on performance characteristics

Develop an appropriate policy portfolio and benchmark for better portfolio monitoring

Putnam's Portfolio Solutions Group does not offer investment advice, and any analysis provided is not intended to make any recommendation or offer advice as to whether any investment or strategy is suitable for a particular investor. The analysis is intended to be an overview of potential types of reports that we can create for a client or model portfolio. The initial analysis focuses on the portfolio allocation. The objective is to provide in-depth understanding of the main drivers of return and risk in the portfolio. The methodology uses a risk-factor-based approach, and utilizes historical, index-based factor returns, volatilities, and correlations. Should an advisor wish to have alternative scenarios and consider potential portfolio changes, additional reports can be run on the revised portfolio, which can then be compared with the initial portfolio. However, the advisor or other recipient of this material must determine the lineup changes to be reflected in the model to generate the revised portfolio for illustration purposes.