- The Fed's September rate decisions met market expectations.

- The dot plot indicates disagreement amid mixed economic signals.

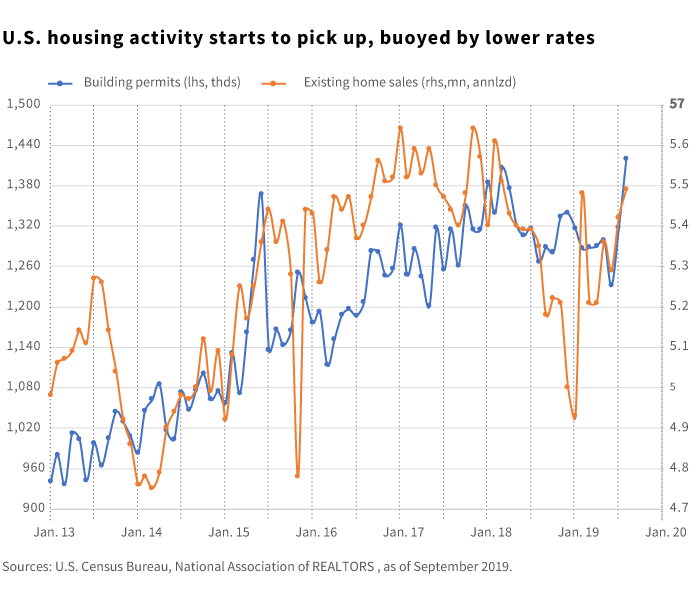

- U.S. housing activity picks up and may be a new complication for the Fed.

The Federal Reserve in September cut its main interest rate — for a second time this year — by another 25 basis points to a range of 1.75% to 2.00%. And in response to stresses in the short-term borrowing markets, the Federal Open Market Committee (FOMC) also lowered the rate it pays on bank reserves. The interest on excess reserves rate (IOER) now stands at 1.8%, after a 30-basis point cut. Neither rate move surprised the market. But the surprise was how the FOMC remains divided; dissenting votes showed up on both sides of the monetary policy spectrum.

“The surprise was how the FOMC remains divided; dissenting votes showed up on both sides of the monetary policy spectrum.”

Dot plot remains wide

Voting members of the FOMC voted 7–3 to cut interest rates this month. St. Louis Fed president James Bullard wanted a deeper 50-basis-point rate cut, while Kansas City Fed president Esther George and Boston Fed president Eric Rosengren once again voted against easing policy. The distribution of the dot plot — a visual representation of where policymakers think rates will be over the short, medium, and long term — is quite wide as well. Seven members of the FOMC envision one more 25-basis-point cut by the end of 2019, but 10 members indicate no further cuts.

Fed chair Jerome Powell said little on the outlook for rates. His reticence reflected the tension within the FOMC, we believe. He did, however, reaffirm comments made in July that policymakers will act as appropriate to sustain the economic expansion, which fueled investors’ speculation that the Fed will ease monetary policy at future meetings. For us, this is nothing more than an emphasis on data dependency.

The United States stays resilient as global outlook slips

Two main factors divide the FOMC: global weakness and domestic strength. FOMC members who pay more attention to weakening global activity would like to preemptively cut the policy rate. Those who focus on U.S. consumers and the labor market prefer to hold rates steady. Therefore, the future policy rate will depend on how these factors evolve and interact.

Global activity is, at best, months away from stabilizing. The eurozone’s economy is struggling, and China’s growth remains sluggish. China has adopted a string of stimulus measures to counter the slowdown. Specific sectors were targeted, with a goal to prevent a further buildup in leverage. While this may help stabilize China’s growth at low levels, it may not be enough for other economies that realigned their growth engines to Chinese demand over the past two decades.

Economies that are relatively closed and have higher domestic consumption potential are likely to fare better in this environment. The United States is one such country. International trade makes up a small share of the U.S. economy compared with the other major economies. This helps insulate the local economy from a global trade recession. In the United States, healthy consumer balance sheets and a strong labor market continue to support consumer confidence and spending.

Housing activity a bright spot

This is where the Fed policy comes into play. When the Fed accelerated the pace of tightening in 2017 and 2018, interest-rate-sensitive sectors of the economy slowed. Housing has typically been a sector responsive to rate movements. Indeed, in 2018, all housing activity — from construction to real estate services — weakened. But when the Fed signaled a dovish turn in the policy rate, housing activity started to recover. As the Fed’s policy rate and mortgage rates trended lower, American home buying strengthened.

August was the strongest month for sales of homes in nearly a year and a half. Sales of previously owned homes rose 1.3% in August from July; the gain marked the first year-on-year uptick in 17 months. It reminds us that rate cuts can still serve as an active monetary policy tool in the United States. The Fed wanted to lessen the negative impact of the global slowdown on the domestic economy. The August housing data indicates that the Fed is winning on that strategy.

Further improvements in the housing market are likely to deepen the division within the FOMC. If the U.S. economy slows with the rest of the world, it can be easier to get a consensus on policy easing. But if lower rates continue to feed into the housing sector and the broader economy, a rising number of officials may push back against more cuts. Under this scenario, the Fed may decide to wait and evaluate new economic data.

We don’t expect another rate cut by the end of the year. Still, that may change if market volatility, growth, or trade conflicts worsen.

Looking to the yield curve for clues

However, global growth remains weak, and financial markets are more volatile in a low-growth environment. The Treasury yield curve remains inverted for many maturities. We believe an upward-sloping curve is important for markets to function smoothly. Therefore, rising volatility may bring Fed officials back to the table for further interest-rate cuts. We forecast the Fed will lower rates twice in 2020 — by 25 basis points each time.

318851

For informational purposes only. Not an investment recommendation.

This material is provided for limited purposes. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument, or any Putnam product or strategy. References to specific asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations or investment advice. The opinions expressed in this article represent the current, good-faith views of the author(s) at the time of publication. The views are provided for informational purposes only and are subject to change. This material does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon. Investors should consult a financial advisor for advice suited to their individual financial needs. Putnam Investments cannot guarantee the accuracy or completeness of any statements or data contained in the article. Predictions, opinions, and other information contained in this article are subject to change. Any forward-looking statements speak only as of the date they are made, and Putnam assumes no duty to update them. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties. Actual results could differ materially from those anticipated. Past performance is not a guarantee of future results. As with any investment, there is a potential for profit as well as the possibility of loss.

Diversification does not guarantee a profit or ensure against loss. It is possible to lose money in a diversified portfolio.

Consider these risks before investing: International investing involves certain risks, such as currency fluctuations, economic instability, and political developments. Investments in small and/or midsize companies increase the risk of greater price fluctuations. Bond investments are subject to interest-rate risk, which means the prices of the fund’s bond investments are likely to fall if interest rates rise. Bond investments also are subject to credit risk, which is the risk that the issuer of the bond may default on payment of interest or principal. Interest-rate risk is generally greater for longer-term bonds, and credit risk is generally greater for below-investment-grade bonds, which may be considered speculative. Unlike bonds, funds that invest in bonds have ongoing fees and expenses. Lower-rated bonds may offer higher yields in return for more risk. Funds that invest in government securities are not guaranteed. Mortgage-backed securities are subject to prepayment risk. Commodities involve the risks of changes in market, political, regulatory, and natural conditions. You can lose money by investing in a mutual fund.

Putnam Retail Management.