The current tax environment and potential for higher tax rates in the future create an opportunity for tax-smart planning.

Investors may want to consider certain strategies to hedge against the risk of higher taxes, including using a Roth IRA conversion.

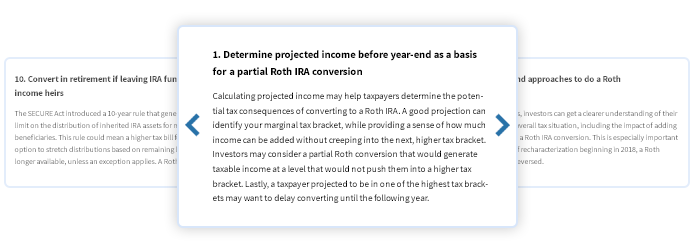

Here are 10 Roth IRA strategies to consider.

Tax-smart planning

A myriad of factors may suggest higher taxes soon. These include the expiration of most tax provisions in 2025, unprecedented federal budget deficits, and uncertain tax policy as a new administration and Congress gains hold in Washington.

It’s important for investors to work with a tax consultant or financial professional who has knowledge of their personal financial situation. A Roth conversion requires a thoughtful decision, since in most cases, taxable income is being generated on the transaction. The decision to complete a Roth conversion also cannot be reversed.

325589

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.