Choosing a fund for retirement savings can be easier than you think.

Target-date (TD) funds keep you on a path to retirement with automatic features. Find your TD fund quickly with this tool.

Automatic diversification at all times

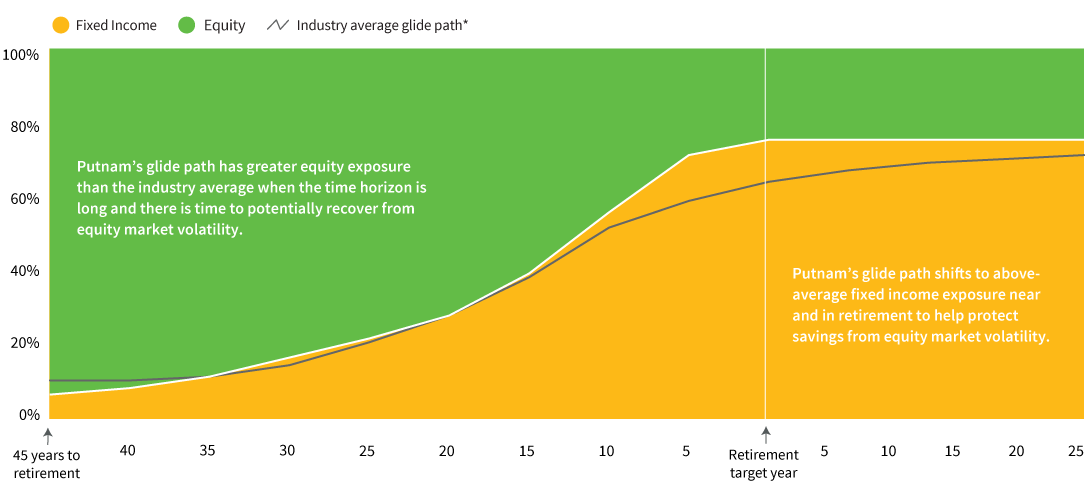

Each fund, including Putnam Retirement Advantage Trust, has an automatic feature that adjusts investment diversification to reduce risk over time. This feature is called the glide path.

No matter when you start saving, the glide path determines the stock-bond balance that is right for your time horizon, and it guides the portfolio's diversification as you make progress toward retirement. Below you can see examples of different stages along the glide path.

1. Starting out

Start investing for growth early in the glide path, even when paying expenses such a student loans.

2. House and family

Saving while the glide path favors stocks can help your nest egg grow as household costs increase.

3. Kids go to college

The glide path shifts investments to reduce risk as you meet college and other expenses.

4. Retirement

Closer to and in retirement, the glide path favors stable investments and income generation.