For those age 65 and older, Medicare serves as the main source of health coverage. Today, more than 60 million people are enrolled, with that number expected to exceed 80 million in 25 years.

Health-care expenses are a leading concern for savers and retirees. Costs are projected to continue to rise faster than wages and overall inflation. As people age, health-care spending takes up a larger percentage of household income.

Those approaching retirement, as well as retirees, know it’s important to make the right choices around health coverage.

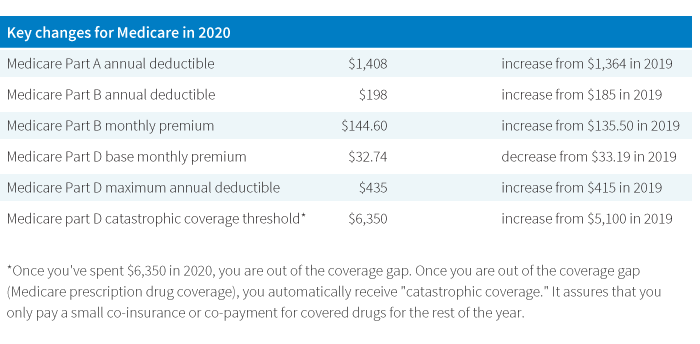

Changes announced for 2020

Policy updates and annual inflation adjustments drove several program changes for next year. There are new rules around prescription drug coverage. Changes have been implemented in the Medigap program for those enrolling for the first time. In addition, there are many new benefits available for 2020 Medicare Advantage Plans.

What about costs?

For 2020, the Centers for Medicare & Medicaid Services (CMS) has published changes to deductibles and premiums.

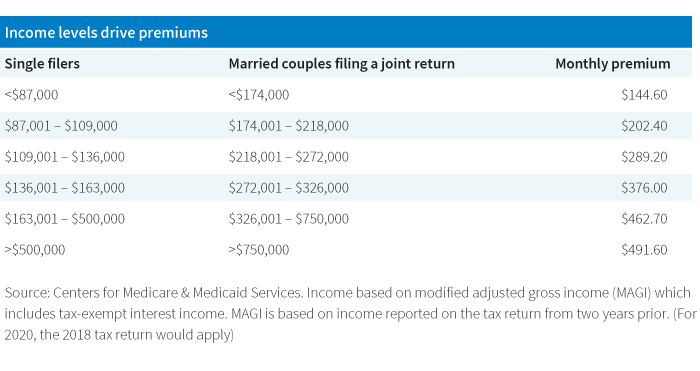

Monthly premium costs can vary by income level. The following chart illustrates the updates for 2020 for Medicare Part B.

Additional changes for 2020

- The Medicare Part D “donut hole” no longer exists. This was a coverage gap in the Medicare Part D system where, after spending a certain amount for drug costs, the percentage amount the beneficiary was liable for increased dramatically

- Medigap plan types C and F are no longer available for purchase

Seek advice

To get started, new and existing participants can find helpful information from Medicare to get started. Visit Medicare.gov to review the handbook. Also, read Putnam’s investor education article, “Three key things to understand about Medicare.” Navigating health coverage can be complicated. A financial advisor can help guide participants to make the choices that best fit with an overall financial plan.

319727

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.