- Municipal bonds remain exempt from income taxes under the new tax law

- However, new prohibitions on refundings will decrease supply in the muni sector

- We are evaluating potential unintended consequences of the legislation

In the tax code overhaul approved in December, the $3.8 trillion municipal bond market retained its tax-exempt status and was largely unchanged. However, the market will likely see a reduction in supply in 2018 because of certain provisions in the new law.

The Tax Cuts and Jobs Act represents, on some measures, the biggest change in the tax code since President Reagan’s Tax Reform Act of 1986. One thing that didn’t change is the exemption for municipal bonds. Congress has talked about limiting or eliminating the tax-exempt status of municipal bonds since the flat tax debate in 2010, but that idea did not make it into the final legislation for 2018.

Refundings are on the ropes

At the same time, the overhaul included a provision that is likely to influence technical factors in the market. The tax reform eliminates tax-favorable treatment of advance refunding bonds. It could easily result in a 20% reduction in the annual supply of munis.

A refunding occurs when an issuer refinances a bond by floating a second bond at a lower interest rate. Paying off the older, higher-yielding bond reduces the issuer’s interest costs.

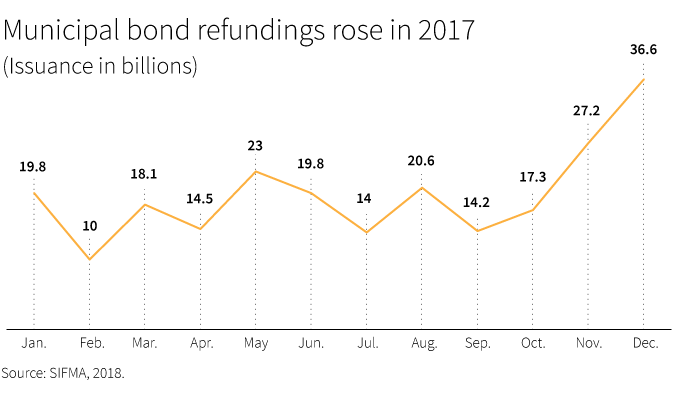

Advance refundings represent a significant portion of the muni market. In 2017, refundings accounted for 54% of total issuance for the year (SIFMA).

Foreshadowing the potential consequences of the repeal, many issuers in the weeks leading up to the tax reform vote rushed to refund in anticipation of the new tax landscape.

Outlook for demand is stable

While the supply of municipal bonds could see some fluctuation, the demand for municipal bonds is expected to remain largely stable. With the marginal income tax rates for individuals staying basically unchanged in the new structure, demand on the part of individuals is not expected to change significantly. In fact, as the new law caps state and local tax deductions, there may be increased demand by investors in high-tax states seeking to capture the additional tax benefit offered by state municipal bonds.

Corporate buyers consider their options

Corporate investors, on the other hand, may find munis less compelling, given their lighter tax burden under the reform. This could lessen demand for munis from banks, property and casualty insurers, and other institutions. Banks have more than doubled their investment in municipal bonds in the past 10 years. Any significant interruption in bank demand has the potential to weigh on the prices of long-maturity municipal bonds.

While activity in the banking sector warrants monitoring, we believe that demand from the sector may be relatively stable in the coming year, at least.

Unintended consequences could emerge

A risk that is not unique to the municipal bond market involves discovering the unexpected effects of new legislation. This is particularly true given that this complex tax package was put together in a short amount of time. Indeed, the fact that Congress advanced the legislation in roughly three months indicates that there was little time to articulate many consequences for the economy. We will be monitoring the market closely to identify how participants are responding to the new law, and we will be watching for unexpected developments.

309830

For informational purposes only. Not an investment recommendation.

This material is provided for limited purposes. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument, or any Putnam product or strategy. References to specific asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations or investment advice. The opinions expressed in this article represent the current, good-faith views of the author(s) at the time of publication. The views are provided for informational purposes only and are subject to change. This material does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon. Investors should consult a financial advisor for advice suited to their individual financial needs. Putnam Investments cannot guarantee the accuracy or completeness of any statements or data contained in the article. Predictions, opinions, and other information contained in this article are subject to change. Any forward-looking statements speak only as of the date they are made, and Putnam assumes no duty to update them. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties. Actual results could differ materially from those anticipated. Past performance is not a guarantee of future results. As with any investment, there is a potential for profit as well as the possibility of loss.

Diversification does not guarantee a profit or ensure against loss. It is possible to lose money in a diversified portfolio.

Consider these risks before investing: International investing involves certain risks, such as currency fluctuations, economic instability, and political developments. Investments in small and/or midsize companies increase the risk of greater price fluctuations. Bond investments are subject to interest-rate risk, which means the prices of the fund’s bond investments are likely to fall if interest rates rise. Bond investments also are subject to credit risk, which is the risk that the issuer of the bond may default on payment of interest or principal. Interest-rate risk is generally greater for longer-term bonds, and credit risk is generally greater for below-investment-grade bonds, which may be considered speculative. Unlike bonds, funds that invest in bonds have ongoing fees and expenses. Lower-rated bonds may offer higher yields in return for more risk. Funds that invest in government securities are not guaranteed. Mortgage-backed securities are subject to prepayment risk. Commodities involve the risks of changes in market, political, regulatory, and natural conditions. You can lose money by investing in a mutual fund.

Putnam Retail Management.