- Millennials are 50% more likely than Gen-Xers to save more than 5% of their paycheck (Source: Bankrate)

- However, millennials are using taxable savings accounts for their retirement savings in greater numbers than older workers do

- The majority of millennials cite lack of availability as the reason for using a bank account rather than a qualified plan

Younger workers are saving for retirement, but they may be missing out on the tax advantages of a qualified plan.

While employer-sponsored defined contribution plans or individual retirement accounts (IRAs) offer tax incentives to save, the majority of adults in a recent survey — 55% — reported that they use a regular savings account to save for retirement. Among millennials — those between the ages of 18 and 34 — that percentage rises to 63%.

Just 50% in the NerdWallet/Harris Poll of some 2,000 adults stated that they use a workplace retirement plan such as a 401(k), and 39% also use IRAs.

Access to a workplace savings option is not universal

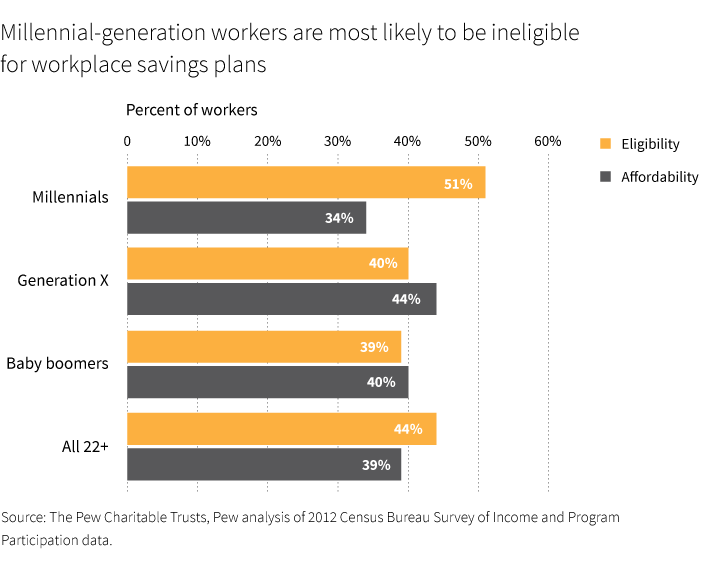

Older workers participate in 401(k) plans at higher levels than millennials and largely for the simple reason that older workers have greater access to such plans. According to worker surveys conducted by the Pew Charitable Trusts, more than half of millennials (51%) cite ineligibility as the reason that they do not participate in a workplace savings plan. Among the baby boom generation, only 39% of workers report this reason as a hindrance to savings.

The type of work millennials find can make a difference. New college graduates may have a difficult time finding a job with retirement benefits, or they may be working in part-time jobs and logging fewer hours than required to qualify for benefits. Many also do freelance work, which typically does not provide access to a 401(k). For those who find a job with benefits, there may be a waiting period for new hires. Also, workplace plans without auto-enrollment features may be letting younger workers slip through the net.

Affordability is another issue. But even accounting for income, millennials are less likely to participate in a 401(k) than boomers, Pew found.

The predicament millennials face may be one reason why, today, there are 43 million workers nationwide without access to workplace savings (Source: Bureau of Labor Statistics, 2016).

Employer match can make a big difference

Across all generations, participation in a 401(k) plan increases when plans include matching contributions from employers, Pew’s research noted. In plans with an employer match, 81% of millennials and 80% of boomers participate. Without a match, only 56% of eligible millennials participate, compared with 74% of boomers.

307605

For informational purposes only. Not an investment recommendation.

This material is provided for limited purposes. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument, or any Putnam product or strategy. References to specific asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations or investment advice. The opinions expressed in this article represent the current, good-faith views of the author(s) at the time of publication. The views are provided for informational purposes only and are subject to change. This material does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon. Investors should consult a financial advisor for advice suited to their individual financial needs. Putnam Investments cannot guarantee the accuracy or completeness of any statements or data contained in the article. Predictions, opinions, and other information contained in this article are subject to change. Any forward-looking statements speak only as of the date they are made, and Putnam assumes no duty to update them. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties. Actual results could differ materially from those anticipated. Past performance is not a guarantee of future results. As with any investment, there is a potential for profit as well as the possibility of loss.

Diversification does not guarantee a profit or ensure against loss. It is possible to lose money in a diversified portfolio.

Consider these risks before investing: International investing involves certain risks, such as currency fluctuations, economic instability, and political developments. Investments in small and/or midsize companies increase the risk of greater price fluctuations. Bond investments are subject to interest-rate risk, which means the prices of the fund’s bond investments are likely to fall if interest rates rise. Bond investments also are subject to credit risk, which is the risk that the issuer of the bond may default on payment of interest or principal. Interest-rate risk is generally greater for longer-term bonds, and credit risk is generally greater for below-investment-grade bonds, which may be considered speculative. Unlike bonds, funds that invest in bonds have ongoing fees and expenses. Lower-rated bonds may offer higher yields in return for more risk. Funds that invest in government securities are not guaranteed. Mortgage-backed securities are subject to prepayment risk. Commodities involve the risks of changes in market, political, regulatory, and natural conditions. You can lose money by investing in a mutual fund.

Putnam Retail Management.