Confirm a portfolio

is appropriately positioned

Set performance

expectations based on

portfolio characteristics

Try TargetDateVisualizer to

align your target-date fund

with your philosophy

See risks below the surface

Contact our Portfolio Solutions professionals to analyze your current retirement strategy. Our team can help you analyze portfolios to identify and track dozens of risk factors, including:

- Equity market, size, style, and sector risks

- Interest-rate (duration), high-yield spread risks

- Commodities and foreign currency risks

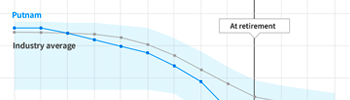

See what separates target-date funds

Try our TargetDateVisualizer tool for a better view of the target-date series you currently use and to identify potential alternatives. The tool gives you a lens to see the glide path philosophy of each target-date series.

- Compare over 100 managers

- See differences in glide paths

- Identify managers aligned with your philosophy

- Get an in-depth report

Try TargetDateVisualizer or contact our team

You can start your portfolio analysis with TargetDateVisualizer or by contacting Putnam to arrange a call using the form below.

Brendan T. Murray

Head of Global Investment Strategies

Seamus S. Young, CFA

Senior Investment Director, Team Leader

Fixed Income

Daniel W. Lahrman, CFA

Senior Investment Director, Global Asset Allocation

Jonathan M. Schreiber, CFA

Senior Investment Director, Team Leader

Global Asset Allocation

Do you prefer a self-directed approach? Explore the FundVisualizer® analysis tool. If you prefer to contact a specialist at Putnam, use the form below.

Contact Putnam to schedule a call with our team.

Putnam's Portfolio Solutions Group does not offer investment advice, and any analysis provided is not intended to make any recommendation or offer advice as to whether any investment or strategy is suitable for a particular investor. The analysis is intended to be an overview of potential types of reports that we can create for a client or model portfolio. The initial analysis focuses on the portfolio allocation. The objective is to provide in-depth understanding of the main drivers of return and risk in the portfolio. The methodology uses a risk-factor-based approach, and utilizes historical, index-based factor returns, volatilities, and correlations. Should an advisor wish to have alternative scenarios and consider potential portfolio changes, additional reports can be run on the revised portfolio, which can then be compared with the initial portfolio. However, the advisor or other recipient of this material must determine the lineup changes to be reflected in the model to generate the revised portfolio for illustration purposes.