Equity

Active strategies seeking long-term outperformance

We offer a range of attractive equity portfolios for DC plans, including multiple 4- and 5-star funds.

Equity strategies with a record of solid performance

| Name of fund | Category | Overall Morningstar RatingTM as of 06/30/24 |

Retirement share class expense ratio |

|---|---|---|---|

| Core Equity Fund | Blend | (out of 1,302 in category) | 0.64 |

| Global Health Care Fund | Global Sector | (out of 161 in category) | 0.72 |

| Large Cap Growth Fund | Growth | (out of 1,092 in category) | 0.54 |

| Large Cap Value Fund | Value | (out of 1,099 in category) | 0.55 |

| Research Fund | Blend | (out of 1,302 in category) | 0.68 |

| Small Cap Growth Fund | Growth | (out of 550 in category) | 0.85 |

| Emerging Markets Equity Fund | Blend | (out of 718 in category) | 1.13 |

| Focused Equity Fund | Blend | (out of 1,302 in category) | 0.74 |

| Global Technology Fund | Global Sector | (out of 231 in category) | 0.73 |

| International Capital Opportunities Fund | Blend | (out of 90 in category) | 1.16 |

| International Equity Fund | Blend | (out of 679 in category) | 0.83 |

| International Value Fund | Value | (out of 330 in category) | 0.92 |

| Sustainable Future Fund | Growth | (out of 510 in category) | 0.68 |

Putnam Large Cap Growth Fund (PGOEX)

Durable growth themes and companies that benefit from them

A thematic approach is a distinctive feature of the fund. The team analyzes global trends, as well as problems and potential solutions, to identify which themes could drive sustained growth for businesses over a multi-year time horizon.

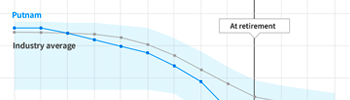

See the fund's consistent outperformance versus peers

Get details on performance, holdings, and sector weightings

Fund detailsPutnam Large Cap Value Fund (PEQSX)

(also available as a CIT)

A multidimensional approach to value investing.

A focus on dividend growth and defining value outside the index. The fund invests in three dimensions of value:

VALUE STOCKS

Attractively priced stocks of companies that are poised for improvement

DIVIDEND GROWERS

Stocks of companies that are willing and able to increase their dividends

CASH-FLOW GENERATORS

Stocks of companies with strong cash flows, earnings quality, and capital allocation strategies

See how the fund has consistently ranked in the top quartile

Learn about the fund's differentiated process

A multidimensional approach to value investing brochure (PDF)Get details on performance, holdings, and sector weightings

Fund details or CIT detailsPutnam Small Cap Growth Fund (PLKGX)

(also available as a CIT)

Seeking to capitalize on growing small companies

Small companies can add an attractive source of long-term investment growth for participants of a retirement plan. These companies tend to be flexible and innovative, and can often grow their earnings at faster rates than larger companies.

The portfolio is diversified across two primary types of small company stocks: high-quality growth and aggressive growth. This portfolio offers growth with a more moderate level of volatility that may be compelling for retirement investors.

HIGH-QUALITY GROWTH COMPANIES

60% to 80% of the portfolio

The largest portion of the portfolio consists of stable, well-established growth companies we believe to be mispriced by the market.

The small-cap asset class can be volatile, especially when targeting the fastest-growing companies. To help moderate the fund's volatility over time, we invest a majority of assets in stable, well-established companies that are often less volatile than the asset class as a whole. We believe these companies can grow at high rates, and that the market is not pricing in their full profitability potential.

AGGRESSIVE GROWTH COMPANIES

20% to 40% of the portfolio

A smaller portion of the portfolio is invested in emerging growth and cyclical growth companies. We define emerging growth companies as those that offer disruptive products, services, or technology that will enable them to grow rapidly. They are typically early in their life cycles, and their quality metrics, such as return on capital or margins, may look weak today. However, if they grow at the rates we are projecting, they could mature into high-quality growth leaders. We put less emphasis on cyclical growth companies, but we will own them if we believe they are competitively positioned and offer durable growth prospects.

Get details on performance, holdings, and sector weightings

Fund details or fact sheetTimely articles and key literature

The power of diversified alpha

Our diversified alpha approach seeks to avoid performance extremes. We use a stock-driven, rather than style-driven, process that gives us the chance to outperform our benchmarks in all market environments.

| December 20, 2023