Putnam Stable Value Fund

We offer a stable value fund as an option for principal stability and attractive income opportunities.

See Putnam Stable Value Fund product informationA conservative style focused on liquidity management

Stability

The fund seeks to maintain the stability of a money market fund while offering returns similar to those of intermediate-term bonds.

Income

The strategy can pursue income with improved interest-rate tracking over time by consistently reinvesting without having to realize gains and losses.

Flexibility

The portfolio's flexibility offers workplace retirement plans increased potential to meet participant and sponsor needs.

Diversified portfolio structure reduces liquidity risk

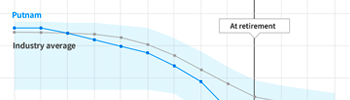

Putnam Stable Value Fund combines four key components in a withdrawal hierarchy for managing liquidity.

Cash buffer: Minimum cash requirement of 5%

Traditional GICs: Laddered across maturities and diversified among several issuers

Synthetic structured cash flow portfolio: Part of the fund's liquidity structure, managed to the Bloomberg 1-5 year Government/Credit Index

Synthetic actively managed portfolio: Managed exclusively for total return against the Bloomberg Intermediate U.S. Aggregate Index

Go to Putnam Stable Value Fund product informationFrequently Asked Questions

What types of plans may be invested in stable value?

Stable value funds are conservative investment options created exclusively for U.S. qualified retirement plans, including 401(k), profit sharing, money purchase, governmental 457 plans, and certain 403(b) plans. Stable value funds are not available to defined benefit plans, IRAs, most 403(b) plans, SEP, or SIMPLE plans.

What is the equity wash rule?

The equity wash rule is the one participant-level liquidity provision related to stable value. The rule requires that participants transfer assets from stable value to a non-competing fund and keep them there for a minimum of 90 days before the transfer to a competing fund takes place. It is known as the "equity wash" rule because equity funds were historically the "non-competing" fund used to invest the transfer funds for the 90-day waiting period, although today that is not necessarily always the case. Generally speaking, a competing fund includes money market funds or other short-term bond funds with a duration less than two years.

How do you manage your put?

Similar to other commingled stable value funds, advance written notice is required for any plan terminations. We should be notified at least 60 days prior to any plan-level distribution (or as soon as administratively reasonable, if that is not possible). In practice, we work to pay clients out on their desired transfer date; however, the Trustee (Putnam Fiduciary Trust Company, LLC) has absolute discretion regarding when to disburse withdrawals during that 12-month period and seeks to base the decision on the best interest of the remaining investors in the portfolio. Along with the plan termination notice, please include the plan sponsor's desired date of transition. Typically, we provide information regarding our ability to potentially pay out the plan assets no more than 45 days in advance of the desired date of transition. For more information, please refer to the Offering Statement. To receive the termination notice, please contact your DCIO Investment Specialist.