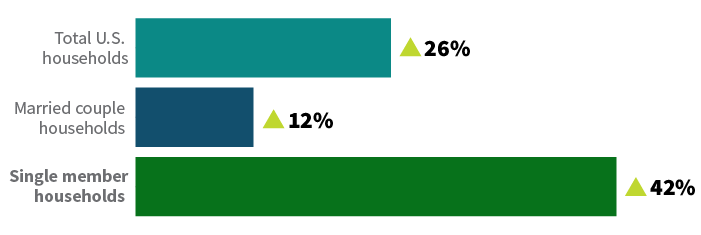

Over the past two decades, single individuals have emerged as the fastest-growing type of household in the U.S. The share of single member households has risen much faster than married couples. Currently, more than a quarter of all households comprise one person.

Some of the drivers of this shift in household demographics include the trend of delaying marriage, falling birthrates, and more widows living alone than ever before.

Single households rising at a fast pace (2000–2003)

Source: U.S. Census Bureau, Cumulative increase in U.S. households, 2000-2023.

Planning considerations and challenges

Single individuals may face unique challenges in financial planning. They normally bear the sole responsibility for household finances and savings programs. In the case of married couples, one spouse may be able to take the “lead” on managing finances.

Without additional resources, or shared resources, single individuals may be more vulnerable to financial shortfalls, making proper financial planning particularly important.

Lack of benefits can also result in financial shortfalls. For those never married, there is no access to Social Security spousal, divorced, or survivor benefits, and they are not as likely to be named as a beneficiary of a retirement account such as a married spouse.

Here are some key areas to focus on during planning discussions.

Retirement considerations

- Savings and planning for income in retirement is especially critical since the single individual cannot rely on a spouse or partner to help address any shortfalls in planning. Without proper planning, mistakes may be amplified

- It's critical for individuals who are divorced or widowed to clearly understand Social Security benefits (for surviving spouses see "Benefits for your spouse," and for divorced individuals, see "Benefits for your divorced spouse."

- Retirees living alone will often receive lower, total Social Security benefits once a spouse passes away

- Naming a beneficiary on retirement accounts is even more critical for singles to make sure wishes are carried out. Naming beneficiaries can help heirs avoid going through the probate process. It can also help ensure that your estate is not subject to state laws governing who inherits your savings if no beneficiary is named. This may not occur with married couples. For example, IRA custodial agreements will typically default to a spouse as beneficiary in the event no one is designated

The role of insurance and risk management

- Proper disability insurance is especially critical in the event an individual cannot work and needs access to cash flow to meet expenses

- Life insurance coverage is important if the individual provides any financial assistance to others or would like to pass wealth on to heirs

- Also, life insurance can be a way to provide liquidity at death to handle expenses or taxes associated with settling an estate

- Attention may be needed to address long-term care expenses since a single individual cannot rely on a spouse for care, and if they don't want to be a burden to other family members

Tax implications for single filers

- Taxpayers who are newly filing as single need to be aware of potential implications of the new filing status. Depending on their level of income, they may be subject to a higher marginal tax rate and less deductions (e.g., standard deduction for a married couple in 2024 is $29,200 and only $14,600 for single filers)

- For instance, single taxpayers reporting $250,000 in taxable income fall into the 32% marginal income tax bracket, while married couples at the same income level would be subject to a 24% marginal tax rate

- Single taxpayers can shelter a maximum of $250,000 in capital gains upon the sale of a primary residence, while married couples can shelter $500,000

Estate planning and wealth transfer

- Transfers between married couples are not considered taxable gifts, while individuals are subject to the annual and lifetime exclusion amounts on all gifts

- Higher-net-worth individuals may have to plan for federal or state estate taxes since they cannot take advantage of leaving assets to a surviving spouse and benefit from the unlimited marital deduction. For example using trust strategies for gifting purposes, making use of annual gifts (up to $18,000 per recipient in 2024), funding 529 plans for family members, or utilizing life insurance as a means to transfer wealth or provide liquidity at death

- Without the benefit of a spouse or partner, careful consideration must be made on establishing important documents such as a power of attorney, health care proxy, and advanced medical directives

- To avoid probate consider titling financial assets as "Transfer on Death" (TOD) or "Payable on Death" (POD), or establishing a revocable trust to pass real property to heirs

Financial planning is critical

Single member households may face many challenges when it comes to financial planning, that are different than the needs of married couples. With the surge in single households, advisors may find there is a growing demand for comprehensive planning, including current financial management, and retirement and estate planning from single individuals.

336382

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.