As a result of high-profile cases and legislative changes, owning company stock in a workplace retirement plan is not as common as it was two decades ago. Today, less than 5% of total 401(k) assets are held in company stock, according to the Investment Company Institute.

For participants holding company stock in their plan and considering a distribution, there are strategies that may potentially help them save on taxes.

Understanding the options is important before taking action.

Elevated risk drew headlines

Several high-profile events brought more attention to the potential risks of owning company stock in an employer retirement plan.

For example, in 2002 when Enron declared bankruptcy, 62% of the assets in their defined contribution plan were held in Enron stock.1

The passage of the Pension Protection Act (PPA) in 2006 provided participants with more flexibility to diversify out of company stock in their retirement plan. For example, if a company provides an employer match in company stock, participants with at least three years of service can transfer those balances to another option offered in the plan. Prior to the legislation, employer plans could limit transfers of employer contributions out of company stock.

While the percentage of company stock held in retirement plans has declined sharply over time, participants still own stock within their plans.

For plans that offer company stock as an investment option, roughly 10% of participants hold a balance of more than 20% in company stock.2

Understanding the NUA option

Federal tax laws include a rule known as the NUA rule (net unrealized appreciation), which applies to the distribution of company stock from an employer retirement plan. Under this provision in the tax code, only the cost basis of the shares is subject to tax (and potentially an early withdrawal penalty) at the time of the distribution. In simple terms, the cost basis is what a person pays for the stock. The difference between the cost basis and the stock’s current price is called the net unrealized appreciation, or NUA.3

The NUA is not subject to tax until the company stock is sold and will never be subject to an early withdrawal penalty. When the stock is sold, the NUA is taxed at long-term capital gains tax rates — not ordinary income tax rates, which can be much higher. Additionally, the NUA is not subject to the 3.8% Medicare surtax on net investment income. The favorable tax treatment for the NUA portion of company stock distributions is what is known as the NUA rule.

Key requirements for applying NUA treatment on company stock

- The distribution from the plan must be a lump-sum distribution (meaning the entire account balance, including other holdings, must be withdrawn from the plan in the same calendar year)

- The company stock is transferred in-kind to a brokerage account (i.e. not sold and distributed in cash)

- If the company stock is rolled into an IRA, the option to apply the NUA rule is forfeited

How the NUA rule works

In this example, consider a plan participant who purchased $50,000 in company stock that appreciated to $300,000 over time. Suppose the individual retired at age 60. The total market value of the company stock is $300,000 and the cost basis is $50,000 – the amount contributed towards purchasing company stock in the plan. The difference between the total value and the cost basis is referred to as the net unrealized appreciation (NUA). In this case, the NUA is $250,000.

Scenario one: Roll the stock into an IRA

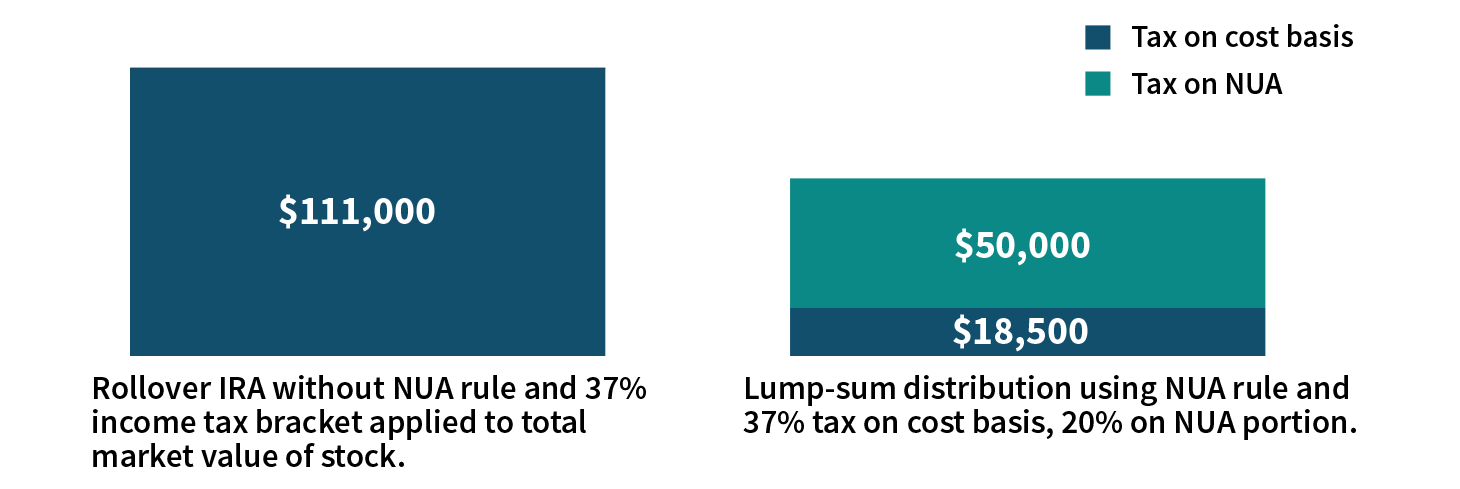

If you liquidated the stock and eventually distributed it from the plan (or rolled the company stock into an IRA and then distributed it), the entire $300,000 would be taxed at your ordinary income tax rate. At the highest marginal tax rate of 37%, the federal income tax bill on the company stock would be $111,000.

Scenario two: Take a lump-sum distribution and apply NUA treatment on the company stock portion

If you take a lump-sum distribution from the plan and transfer the company stock portion in-kind by transferring it to a brokerage account, the NUA rule would apply. First, the cost basis would be reported as ordinary income upon distribution from the plan. Assuming a $50,000 cost basis in our example and a marginal tax rate of 37%, the tax owed on the distribution of the cost basis portion would be $18,500.

The potential tax benefit applies to the difference between the total value of the stock and the cost basis, the NUA. Once the stock is sold, the NUA portion ($250,000 in our example) would be taxed at long-term capital gains tax rates, a maximum of 20%. This would result in a tax bill of $50,000 on that amount ($250,000 x 20%). Adding the ordinary income tax paid on the cost basis portion the total tax bill would be $68,500 ($18,500 + $50,000).

In this example the taxpayer would save roughly $40,000 by not rolling the company stock into an IRA, instead distributing it in-kind to a brokerage account. However, there are important factors to consider when deciding how to distribute company stock from a retirement plan.

Example based on highest marginal tax rates of 37% for ordinary income and 20% for long-term capital gains. Note that the 3.8% Medicare surtax on net investment income does not apply to retirement plan distributions, including NUA.

When does NUA make sense?

Using the NUA rule strategy may make sense if the company stock has realized significant market appreciation, if you are in a high tax bracket, are considering an immediate distribution from your account, or are leaving stock to heirs. In general, the lower the cost basis on the stock and the higher the marginal tax rate, the better the case for using the NUA rule.

When may a Rollover IRA be a viable choice

You may want to consider a Rollover IRA if you want to defer taxes as long as possible or if you wish to diversify your holdings out of company stock. A participant thinking about using the NUA rule has to plan for reporting the cost basis portion of the company stock as ordinary income on their return in the year it is distributed. Many participants may want to avoid paying taxes until later in their retirement years when required distributions begin.

Consult an advisor

It’s always important to consult with a financial professional to determine what may be best for your individual needs. Get advice before taking action to avoid the burden of additional taxes.

1Congressional Research Service, data as of 2002.

2Vanguard, How American Saves, 2023.

3Internal Revenue Code 402(e)(4).

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.