We offer dedicated sustainable equity strategies that pursue capital appreciation through a sustainability focus. We seek companies where strong sustainability traits may potentially contribute to strong financial performance.

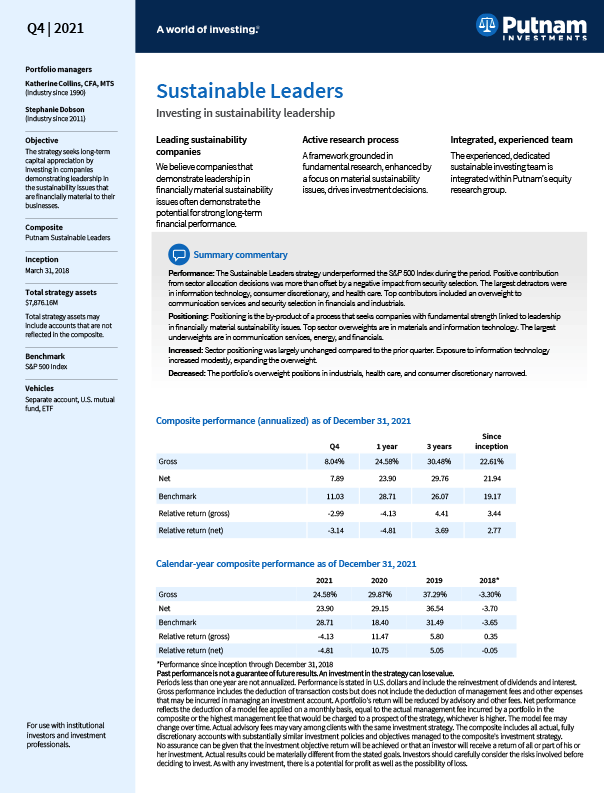

Putnam Sustainable Leaders

The Sustainable Leaders portfolio invests in companies that have demonstrated leadership in the sustainability issues that are financially material to their businesses. We believe companies that exhibit this type of commitment also often demonstrate potential for strong long-term financial performance.

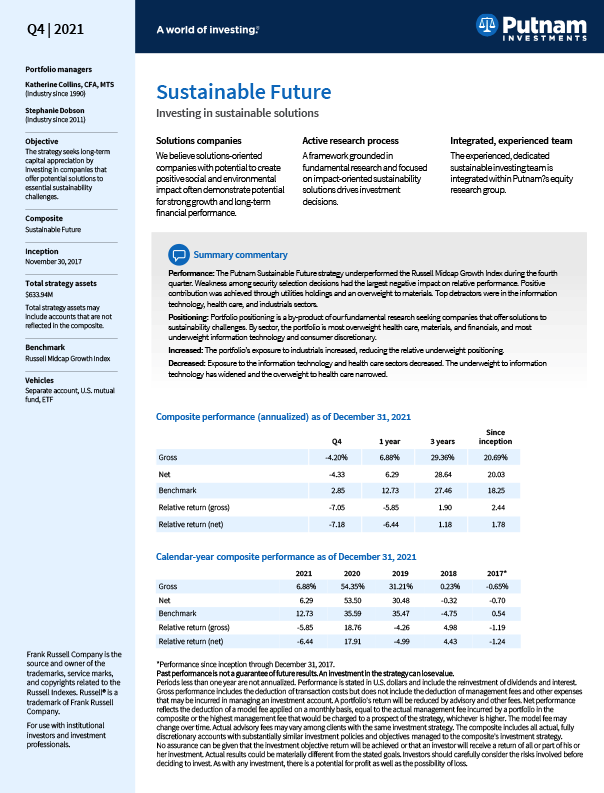

Putnam Sustainable Future

The Sustainable Future portfolio invests in companies whose products and services provide solutions to essential sustainability challenges. We believe solutions-oriented companies can also demonstrate potential for strong growth and long-term financial performance.

Strategy profiles

No assurance can be given that the investment objective will be achieved or that an investor will receive a return of all or part of their initial investment. Actual results could be materially different from the stated goals. As with any investment, there is a potential for profit as well as the possibility of loss. Sustainable Future: Investing with a focus on companies whose products and services may provide solutions that directly impact sustainable environmental, social, and economic development may result in the strategy investing in certain types of companies, industries, or sectors that the market may not favor. Sustainable Leaders: Investing with a focus on companies that exhibit a commitment to sustainable business practices could result in the strategy investing in certain types of companies, industries, or sectors that the market may not favor. In evaluating an investment opportunity, we may make investment decisions based on information and data that is incomplete or inaccurate. Sustainability and ESG factors are not uniformly defined, and applying such factors involves subjective assessments. Sustainability and ESG scorings and assessments of issuers can vary across third-party data providers and may change over time. In addition, a company's business practices, products, or services may change over time. As a result of these possibilities, among others, a strategy may temporarily hold securities that are inconsistent with a strategy's sustainable investment criteria. Regulatory changes or interpretations regarding the definitions and/or use of ESG or other sustainability criteria could have a material adverse effect on a strategy's ability to invest in accordance with its investment policies and/or achieve its investment objective, as well as the ability of certain classes of investors to invest in portfolios whose strategies include ESG or other sustainability criteria. Please note, the Global Sustainable Equity strategy will invest primarily in equities worldwide, with a focus on financially material sustainability issues. This strategy will have substantially more non-U.S. exposure than the regular Sustainable Leaders strategy and is also managed versus a different benchmark (MWSCI World Index versus S&P 500 Index).