An overwhelming majority of businesses in the U.S. are considered small businesses. Of those, 80% — or roughly 25 million businesses — do not have any employees.

The number of self-employed individuals has continued to grow in the past decade, especially with the advent of the gig economy, a driver behind this trend.

Unlike other business owners, these individuals are challenged with having to balance different roles, such as obtaining and maintaining their own benefits, including retirement savings. Surveys found that self-employed individuals are not using a retirement plan to save (Pew Charitable Trusts, 2019). This may jeopardize their ability to retire successfully in the future and preclude them from taking advantage of valuable tax benefits.

There are options for self-employed individuals to effectively save for retirement.

Choosing the right plan

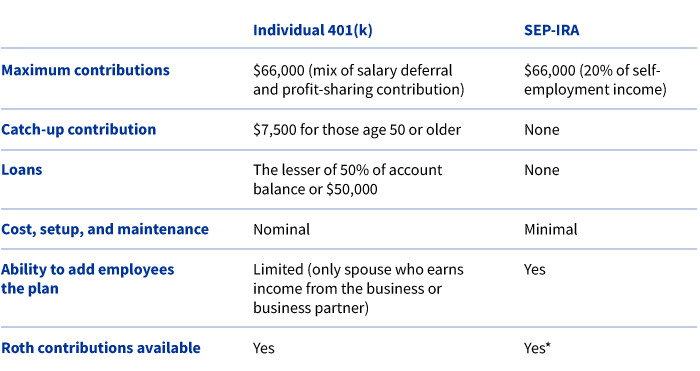

The SEP-IRA and individual or “solo” 401(k) are two popular options for retirement savings. Both are defined contribution plans and feature relatively high annual contribution limits. In addition, recent legislation allows SEP-IRA programs to offer Roth contributions like 401(k) plans.

*SECURE 2.0 legislation allows a SEP-IRA to offer a Roth account option beginning in 2023. Note that as of this date, many providers are still updating systems and procedures to accommodate these recent changes, so the Roth account option may not be available yet depending on the custodian.

Making the case for an Individual 401(k)

Because Individual 401(k) contributions technically consist of (employee) salary deferrals and an (employer) profit-sharing contribution, an individual may be able to contribute more to an Individual 401(k) than a SEP-IRA in certain cases.

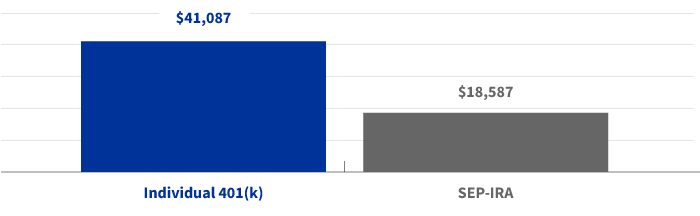

For example, an individual with $100,000 in self-employment income is limited to a 20% contribution into a SEP-IRA. However, that same individual could contribute roughly double that amount using an Individual 401(k), consisting of a salary deferral (up to $22,500) as well as a 20% profit-sharing contribution. If that individual was age 50 or older, the Individual 401(k) would be even more compelling considering the maximum catch-up contribution of $7,500.

Example: 2023 maximum contribution for self-employed individual with $100,000 in net income

Example based on net profit figure reported on Schedule C (Proflt or Loss from a Business) or Schedule K-1 in the case of a partnership. Assumes the individual has not attained age 50.

One other potential benefit is the ability to do a “backdoor” Roth IRA contribution. This strategy may be used by those who cannot directly contribute to a Roth IRA because their income exceeds eligibility limits. For 2023, income phaseouts for Roth IRA contributions begin at $138,000 for single filers and $218,000 for married couples filing a joint return. The so-called backdoor strategy involves making a non-deductible (for example, after-tax) contribution within a traditional IRA and then subsequently converting that amount to a Roth IRA.

There are complications to this strategy, however, referred to as the “pro rata rule.” IRS rules mandate that when an IRA consists of after-tax and pretax funds, each dollar converted to a Roth IRA must include a pro rata portion of each. Converting only after-tax IRA funds to a Roth is not allowed. While funds held within a SEP-IRA are considered as part of the pro rata calculation for determining taxes on a Roth IRA conversion, funds held within an Individual 401(k) are not considered.

See more details about this strategy in our post, “Planning strategies to prepare if taxes move higher.”

Lastly, the loan option available with an Individual 401(k) provides another way to access funds in the plan.

The case for choosing a SEP-IRA

For those who are looking for a low-cost option that is relatively simple to establish, the SEP-IRA may be a better choice. The SEP-IRA also offers the flexibility to add employees without making changes to the plan. However, it’s important that plan contributions are based on a fixed percentage (up to 25% of compensation if there are employees) for all employees including the owner. Contributions may have to be made for part-time workers defined as those who have attained age 21, worked for at least 3 of the last 5 years, and earned at least $750 annually.

Seek advice

Self-employed individuals may want to seek professional financial advice before choosing a plan that is optimal for their financial situation.

334077

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.