The Social Security Administration and the Centers for Medicare & Medicaid Services recently announced key figures for the upcoming year.

After a year of historically high inflation adjustments for Social Security, beneficiaries will receive a lower cost-of-living allowance (COLA) in 2024 based on the current environment. Recipients will still get a 3.2% raise, but it is lower compared with the 8.7% increase received in 2023. In fact, last year marked the highest COLA increase since the early 1980s. Still, the 2024 COLA is a little higher than the average 2.6% increase over the last 20 years.

For Medicare, while there was a slight decrease in plan premiums in 2023 due to an adjustment related to an Alzheimer’s drug, premiums are slated to increase in 2024. For example, the base premium for Medicare Part B will increase from $164.90 a month to $174.70. Also, the annual deductible for all Medicare Part B beneficiaries will be $240 in 2024, an increase of $14 from the annual deductible of $226 in 2023.

Additional changes will impact Medicare Part D plan participants with high drug costs. Under the Inflation Reduction Act, out-of-pocket spending for drugs under catastrophic coverage will be capped at $8,000 in 2024. Also, drug manufacturers will pay a greater share of costs for participants with high drug costs.

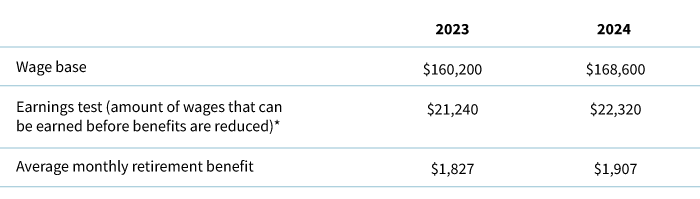

As retirees (and workers) gauge their finances for the upcoming year, here are some key figures to consider.

The impact of inflation on Social Security

*This earnings test only applies in years before attaining full retirement age. A higher earnings amount ($59,520 for 2024) applies during the year of attaining full retirement age. If retirement benefits are withheld because of earnings, benefits will be increased starting at full retirement age to take into account for benefits that were withheld.

Medicare Part B premiums

Source: Centers for Medicare & Medicaid Services. Income based on modified adjusted gross income (MAGI), which includes tax-exempt interest income. MAGI is based on income reported on the tax return from two years prior.

Planning considerations

If possible, taxpayers may want to manage income heading into retirement to avoid facing higher Medicare Part B premiums (note that Medicare Part D premiums also increase at higher income levels). Be mindful that premiums are based on income tax returns from two years prior. For example, your tax return at age 63 will determine premiums when enrolling in Medicare at age 65.

It may be wise to avoid a large surge in income (from a Roth IRA conversion, for example). This influx in income may result in higher Medicare premiums. On a positive note, qualified distributions from Roth accounts are not factored into the calculation to determine Medicare premiums. For that reason, partial Roth IRA conversions while still working may be a way to achieve tax diversification heading into retirement.

Regarding Social Security, those who are still working should not opt to claim benefits prior to their full retirement age since it’s likely that benefits will be withheld due to the earnings test. The earnings test does not apply once an individual reaches their full retirement age (age 67 for those born in 1960 or later). If longevity risk is a concern, consider delaying Social Security past full retirement age. Retirement benefit amounts will increase by 8% for each year delayed up to age 70.

For more insight on planning for Social Security benefits see our investor education resource “Five things you need to know about optimizing Social Security.”

For insight on Medicare benefits please refer to our investor education resource “Three key things to understand about Medicare.”

335468

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.