Home

Putnam 529 for America

Email

LinkedIn

Facebook

INVEST IN THE FUTURE

INVEST IN THE

FUTURE

Choose from a wide range of investment options

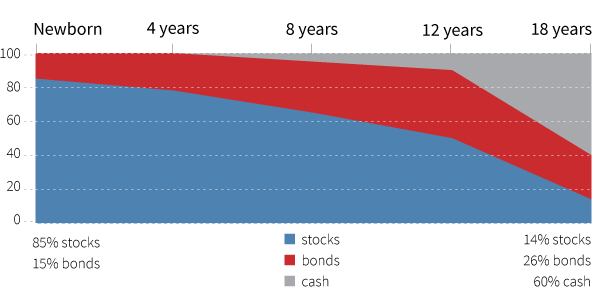

Age-based portfolios

Actively managed and adjust over time, becoming more conservative as a child approaches college age.

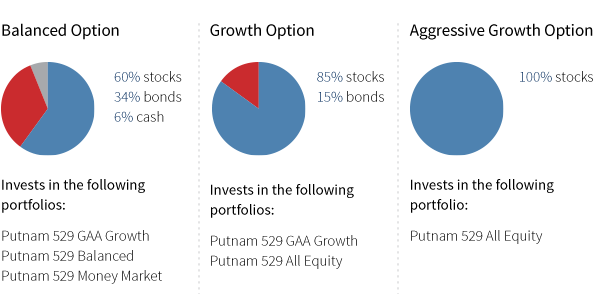

Goal-based portfolios

Actively managed and keep the same allocation mix, regardless of the child's age.

Individual investment options

Build your own portfolio with individual fund options from Putnam and other fund families.

- Federated Hermes Short-Intermediate Government Option

- MFS International Equity Fund Investment Option

- Principal MidCap Fund Investment Option

- Putnam Core Bond Fund Investment Option

- Putnam Government Money Market Fund Investment Option

- Putnam Large Cap Growth Fund Investment Option

- Putnam High Yield Investment Option

- Putnam Income Fund Investment Option

- Putnam Large Cap Value Fund Investment Option

- Putnam Multi-Asset Income Fund Investment Option

- Putnam Small Cap Value Fund Investment Option

- State Street S&P 500® Index Fund Investment Option