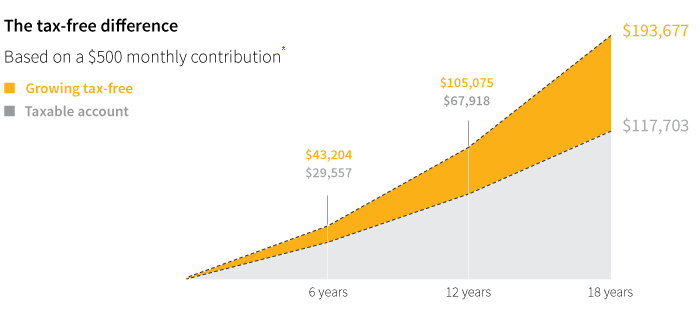

The tax advantages of a 529 plan

No federal income taxes to pay

You pay no federal income taxes on earnings while the 529 account is invested, and pay no federal income taxes when the money is withdrawn to pay for qualified education expenses. In addition, 34 states currently offer tax incentives as well.

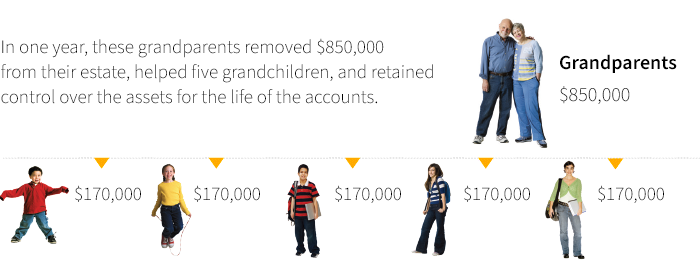

Offset estate taxes

529 plans also offer a unique benefit of decreasing your taxable estate. In certain cases, contributions to the account can be removed from your estate for tax purposes, yet you retain control over the assets. 529 plans also offer a special gift tax exclusion.

Bypass federal gift tax

A special gift tax exclusion of 529 plans enables you to make five years' worth of gifts to a single beneficiary in a single year without triggering the federal gift tax.- Maximum for individuals is $85,000 for 2023

- Maximum for married couples is $170,000 for 2023

Ready for the next steps?

Talk to your financial advisor or call

Ready for the next steps?

Learn about the multiple tax benefits of making Putnam 529 for America part of your plan.

Estate planning fact sheetPutnam 529 for America brochure

Or, talk to your financial advisor or call 1-877-PUTNAM529