The economy's prospects are still slipping as the central bank downgrades its growth forecasts and opts to hold interest rates steady.

Japan typically has a high beta to the global economy. It has been exposed to the global effects of the U.S.–China trade war and to China's growth slowdown. There are also the effects from the hike in the value-added tax (VAT) at the beginning of October and persistent concerns about the risks to the inflation outlook. Household confidence has fallen steadily for more than a year and recently dropped below its post-2011 low.

This is a poor backdrop for a tax hike. While it's too early to have confidence about the impact of the tax hike, the signs so far are not encouraging. The Jibun Bank Flash Japan Services PMI fell to a seasonally adjusted 50.3 from 52.8 in September and 53.3 in August. That pulled the Jibun Bank Flash Japan Composite PMI to 49.8 from 51.5 in the previous month. If the service sector PMI is the clearest read we have so far on the impact of the VAT hike, the manufacturing indicators have also turned down. There was also a sharp drop in a variety of PMI components including the new orders index, which fell despite an uptick in export orders driven by tech exports to Asia excluding China.

Too soon to talk about a recession.

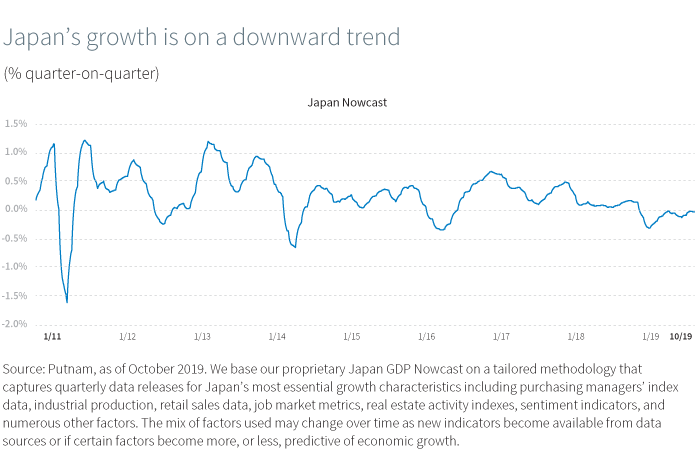

We don't have a recession forecasting model for Japan — it has never seemed worthwhile to build one. But our Japan nowcast has been in negative territory since early in the year, even though the official GDP data have been showing modest growth, so it may well be that we are missing something. Japan has a low potential growth rate, and another mild recession in Japan is not going to send shock waves around the world. We are not forecasting a Japanese recession, but the outlook has deteriorated in the past month and the risks to the outlook are to the downside.

We are not forecasting a Japanese recession, but the outlook has deteriorated in the past month and the risks to the outlook are to the downside.

BoJ leaves rates unchanged

This is the context in which the BoJ did not change its policy settings at its October meeting. However, the central bank made a few noteworthy changes to its statement. It dropped a reference to keeping rates low at least until the spring of 2020, and said it expected rates to remain at current or lower levels as risks to the price outlook remain. In the very short run, it's the exchange rate that generates the most attention in Tokyo. The fact that the yen is a bit weaker than it was a month ago has taken some pressure off the BoJ. But in the bigger picture, the statement reflects the discomfort the BoJ feels at having so little room to move.

The BoJ would like to ease. Central bank Governor Haruhiko Kuroda said recently that "by changing the forward guidance, we made clear our stance that we will conduct our policy operation with more emphasis on easing." Maybe that sounded better in Japanese? Kuroda is trying to be more like Mario Draghi, the former president of the European Central Bank, and find some words that do the job of easing without actually easing. If the global economy really does stabilize at its current pace, perhaps the BoJ will get away without doing anything more. But our view is that some measures are likely in the not-too-distant future. The BoJ edged down its forecasts for both growth and inflation for fiscal year 2020 and 2021.

If the global economy really does stabilize at its current pace, perhaps the BoJ will get away without doing anything more.

More from Macro Report

Download the Macro Report (PDF)The global economy is likely to stabilize at around the current growth rate.