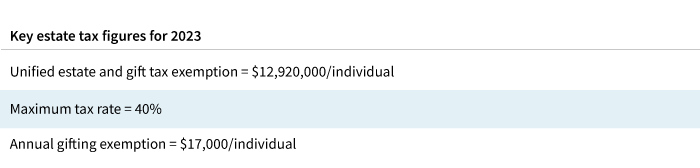

With the federal lifetime gift and estate tax exemption at such a high level, fewer estates will receive an estate tax bill from the federal government. Yet estate planning remains critical as taxpayers will need to make sure important documents are in place and potentially navigate any state tax requirements for the distribution of assets.

In fact, more than a dozen states have death or inheritance tax laws.

In addition, tax provisions of the Tax Cuts and Jobs Act (TCJA) are set to expire in 2025. Key tax figures may change, which could impact taxes and strategies for wealth transfer.

As year-end approaches, here are several strategies for investors to consider as they review their tax and estate planning.

Create a “road map” document

Create a road map document to help family members navigate documents and legacy plans in case of an unforeseen event or death. Family members will need to locate investment accounts, key documents, important contacts, online passwords, and specific instructions on how to proceed. See our recent piece, "Preparing heirs before a loved one passes," for resources.

Review beneficiary designations and other considerations

Review and update plans and documents, including beneficiary designations on retirement accounts, life insurance policies, and annuities. Consider a revocable trust to help heirs avoid probate. In case of incapacitation or a health-related issue, documents such as powers of attorney, healthcare proxies, and living wills are critically important for health- and financial-related decisions.

Use it or lose it — The annual gift tax exclusion

Year-end provides an opportunity to review existing estate plans and consider gifting strategies. The annual gift tax exclusion for individuals in 2023 is $17,000. To avoid utilizing a portion of the lifetime gift and estate tax exclusion (roughly $13 million for 2023), annual gifts can be made to as many recipients as desired as long as each gift doesn’t exceed $17,000 (or $34,000 for married couples electing split gifts).

Consider large lifetime gifts

The significant increase in the lifetime gift and estate tax exclusion since the passage of the TCJA in 2017 means higher-net-worth individuals and families should review existing trusts and other documents with their attorney to see if any modifications are necessary. Also, there may be opportunities to make large lifetime gifts, considering the historically high level of the exclusion amount. The current exclusion level is scheduled to be reduced roughly by half at the end of 2025 unless Congress takes action.

Use 529 plans to fund education for family members

Before the end of the year, consider gifts into 529 plans utilizing the annual gift tax exclusion of $17,000. There is also a special 529-plan exclusion that allows five years’ worth of gifts — up to $85,000, or $170,000 for married couples — to be contributed at once, provided that no other gifts are made within the next five-year period. For federal financial aid purposes, funding a 529 plan may make sense. The federal financial aid calculation treats 529 plans owned by parents more favorably than assets owned by the student (for example, in a custodial minor account). There is an added benefit for non-parents such as grandparents who own 529s. These accounts are not currently factored as assets for determining federal financial aid under the FAFSA process. In addition, recent changes to the FAFSA form do not include distributions from grandparent-owned (and other non-parent-owned accounts) from the income test portion of the FAFSA form. Lastly, recent tax law changes allow 529 account owners to withdraw $10,000 for K–12 tuition expenses and $10,000 to repay student loans, and allow distributions for qualified apprenticeship programs.*

*Distributions for K–12 expenses are free from federal income taxes (taken after December 31, 2017). Earnings may be subject to state income taxes in certain states.

Plan for the 10-year rule

In late 2019, Congress passed the SECURE Act, which eliminated the “stretch” option on distributions from most inherited retirement accounts inherited by non-spouses. Under the new rules, most non-spouse beneficiaries are required to fully distribute inherited account balances by the end of the 10th year following the year the account owner dies. As a result, from a tax perspective, retirement accounts may not be as beneficial when passing wealth to heirs. Those with large 401(k)s or IRAs may want to review their overall estate plan and consider leaving a greater share of non-retirement assets to higher-income heirs. For example, consider proceeds from a life insurance trust or real estate that may benefit from a step-up in cost basis at death when transferred. See our post, “Distribution planning under the SECURE Act.”

Review gift and estate plans with an advisor

When considering making changes to estate or gift plans, it is important to discuss these ideas with a financial advisor. Individuals considering advanced strategies should work with a qualified estate planning attorney with knowledge of their financial situation and goals. Taxpayers can benefit by reviewing their current financial plan with an advisor to make sure they are taking advantage of tax-efficient strategies under the current tax rules. Consider the impact of potential tax changes on estate and gift planning. Read Putnam’s “A closer look at the current estate and gifting tax rules” to begin a review.

335535

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.