For those with inherited retirement accounts, next steps are often unclear.

While the rules stating how long beneficiaries can hold on to inherited funds changed in 2020, the Treasury Department issued guidance earlier this year on how to handle these distributions.

The SECURE Act (Setting Every Community Up for Retirement Enhancement Act of 2019) changed the way inherited retirement accounts are distributed, requiring most non-spouse beneficiaries to fully distribute account balances within 10 years after the death of the owner. This is referred to as the “10-year rule” and starkly different from the “stretch” option, that allowed beneficiaries to distribute inherited retirement accounts gradually, based on their remaining life expectancy.

Given these new rules, here are some key factors to consider when distributing inherited retirement accounts.

For certain beneficiaries the "stretch" strategy remains an option

The SECURE Act created a new definition for certain account beneficiaries — referred to as “eligible designated beneficiaries” (EDBs). These beneficiaries are still eligible for life expectancy payouts:

- Spouses

- Disabled or chronically ill beneficiaries

- Minor children of the account owner (until reaching age 21)

- Beneficiaries not more than 10 years younger than the deceased account owner

Named beneficiaries who do not meet one of these requirements are simply referred to as “designated beneficiaries” and include most non-spouse heirs. There may be instances where no beneficiary is named, or the estate or certain (non-qualified) trust is designated as the beneficiary of the account. These rare occurrences are referred to as “non-designated beneficiaries.” Depending on the circumstances, following the death of the owner, these accounts may have to be distributed within five years.

The 10-year rule applies when the account owner died after 2019

Existing “stretch” distributions where the owner passed away prior to 2020 are grandfathered. However, if the existing beneficiary dies before the account is exhausted, the 10-year rule applies to successor beneficiaries. Additionally, the 10-year rule applies to retirement plans and IRAs, including Roth IRAs.

Trust arrangements may also be subject to the rule

In some instances, trusts are designated as beneficiaries on retirement accounts. Prior to the SECURE Act, if the trust met several requirements and qualified as a “see through” trust, the option to stretch distributions based on the life expectancy of beneficiaries was available. Generally, under the new rules, unless trust beneficiaries are EDBs the 10-year rule applies.

Proposed regulations may change the way the 10-year rule applies

For heirs subject to the 10-year rule, initial interpretation of the legislation suggested that no annual distributions were required. The only requirement was to fully distribute the account by the end of the tenth year following the year of death of the owner.

However, the Treasury Department recently released proposed regulations on required minimum distributions. The latest guidance states that if the account owner died after the required beginning date (RBD), the beneficiary would have to take annual distributions based on their life expectancy for the first nine years, followed by full distribution of the account in the tenth year. These are proposed regulations and subject to change.

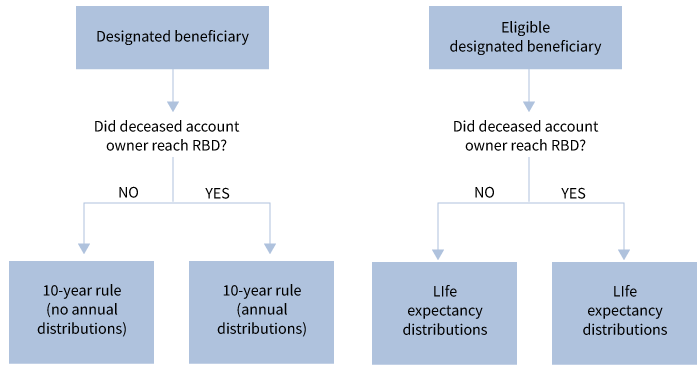

How distributions apply under SECURE Act rules

Based on proposed Treasury regulations subject to change. Required beginning date (RBD) is generally April 1 of the year following the calendar year in which the account owner reaches age 72. In the case of an account owner dying after RBD, designated beneficiaries and eligible designated beneficiaries may opt to base annual distributions on the remaining life expectancy of the deceased account owner. Spousal beneficiaries have the option of rolling over an inherited IRA into their own IRA. While minor children of account owners are eligible for life expectancy distributions, once age of majority (21) is reached the 10-year rule applies. Eligible designated beneficiaries can opt to base distributions on the 10-year rule if desired, provided the original account owner died prior to reaching the required beginning date (RBD).

Planning considerations for account owners and heirs

Since the 10-year rule may result in retirement account balances being distributed sooner than anticipated, there may be unintended income tax issues for beneficiaries.

Here are some potential considerations:

- Account owners may want to leave other assets to higher-income heirs, leaving retirement funds to beneficiaries in lower, or moderate, income tax brackets

- Account owners may consider spending down (or converting to a Roth) retirement funds while living, depending on their tax circumstances

- For those over the age of 70½ qualified charitable distributions (QCDs) may be a tax-efficient method of drawing down IRA funds while satisfying charitable wishes

- Retirement account heirs will want to time taxable distributions from inherited accounts over the 10-year period in conjunction with their personal tax situations

- If possible, heirs of Roth accounts may wish to wait until the last year of the 10-year period before distributing the account, allowing for potential tax-free growth over that period

Seek advice

With any actions that could impact tax planning, it is important to review the rules and the potential impact with a financial advisor. In addition, financial professionals and tax experts are continuing to monitor developments around the SECURE Act as there will be a final interpretation of the 10-year rule at some point. For more detail on how distributions apply under the SECURE Act rules, see our latest education piece, “Distribution planning under the SECURE Act.”

331157

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.