The Tax Cuts and Jobs Act approved expanded use of 529 plans to include tax-free distributions (after December 31, 2017) of up to $10,000 per year per student to pay for tuition at elementary or secondary public, private, or religious schools. 529 plans will continue to offer tax-free withdrawals for college expenses.

Helping families save for education.

The challenge of saving for education is one of the biggest financial demands most families will face.

For over a decade, Putnam's advisor-sold college savings plan has been helping families across America build their futures. Putnam 529 for America combines our investment expertise, 529 plan administration experience, and industry-recognized customer service standards.

Talk to your clients about Putnam 529 for America and how tax-free growth can help offset the potential burden of excessive student debt.

- Your clients can roll over — at NAV — assets from any other 529 plan into Putnam 529 for America.

- You may receive a dealer reallowance for all these rollovers. See your home office for details.

With a range of investments and a host of advisor resources, Putnam 529 for America can help you serve your clients and support their goal of a brighter future for their children.

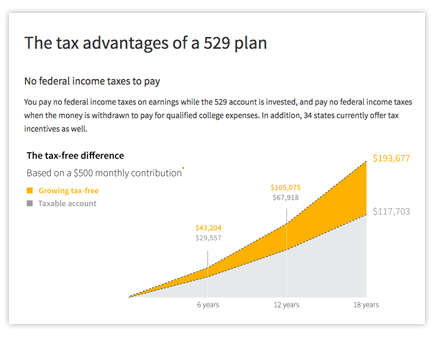

Show your clients the benefits of tax-free growth

Send this email with a link to this page, highlighting the tax benefits of 529 plans.

Share our estate planning fact sheet with clients.

What your client needs to know »

The average cost of tuition and fees for a full-time year at a public, four- year institution is 40% higher than it was a decade ago.

Help clients determine how much they will need.

Try our college savings calculator