Grow your business using social media

Strategies and expertise to build and strengthen relationships

DEVELOP A DAILY 10 MINUTE LINKEDIN ROUTINE

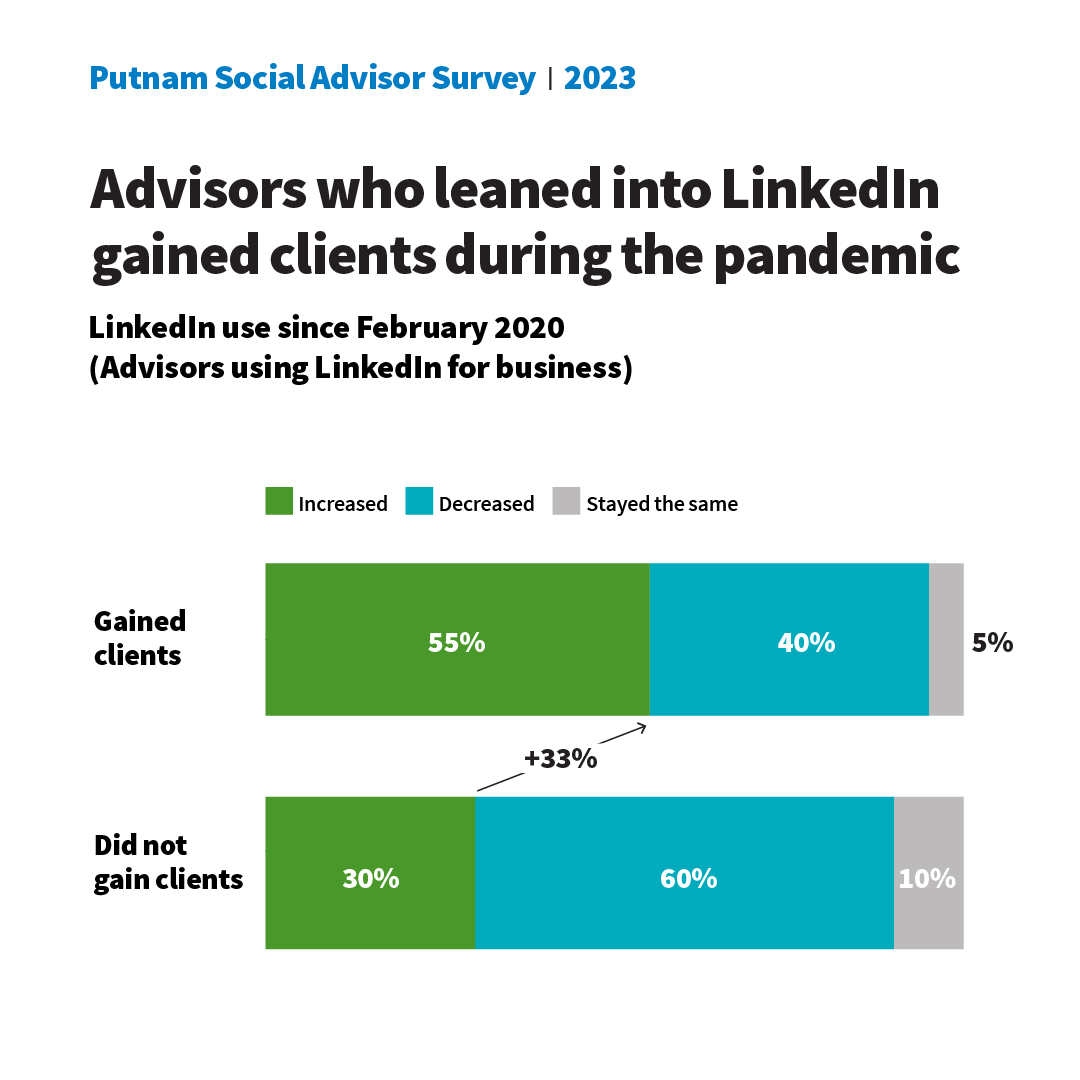

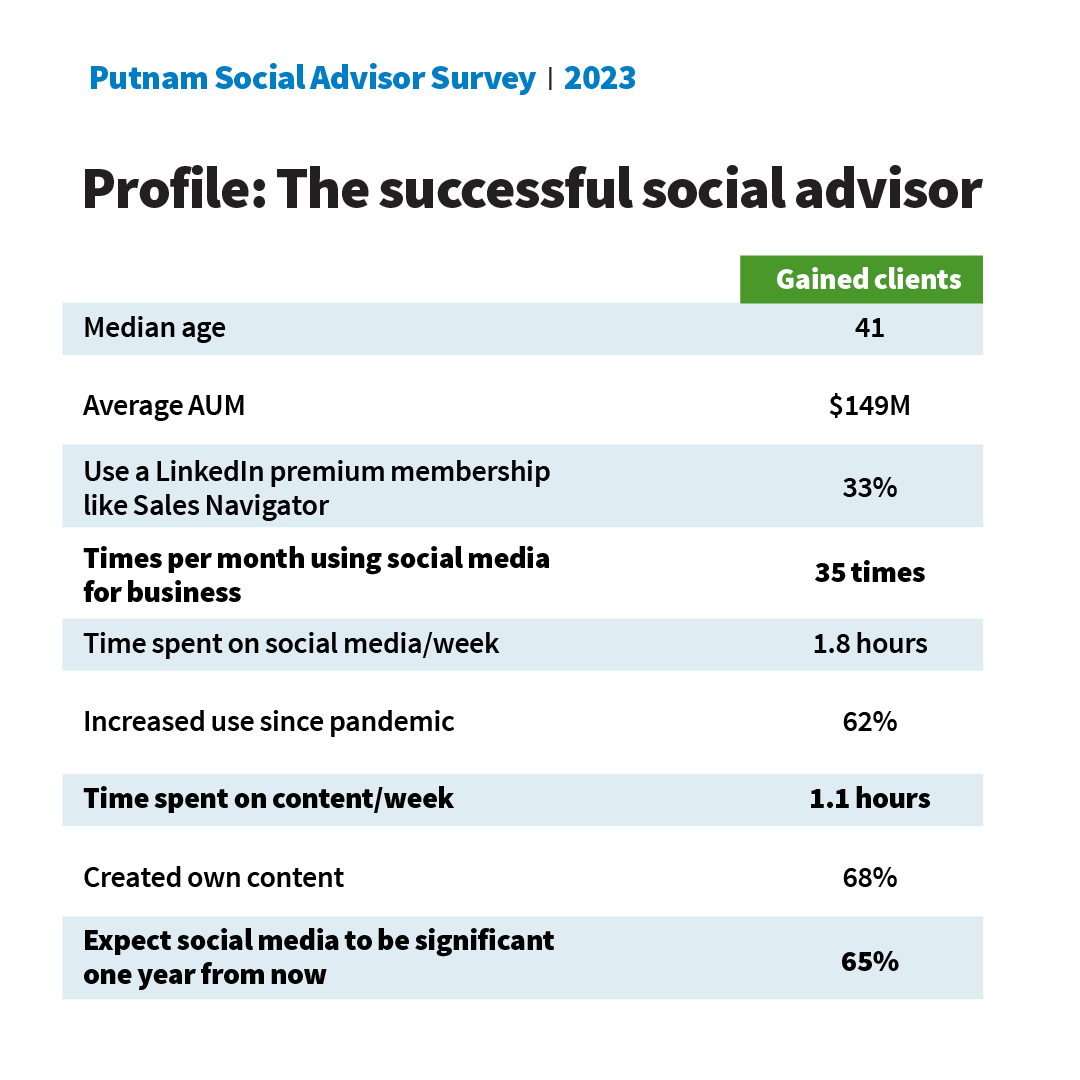

Our research shows that advisors who challenge themselves to use LinkedIn strategically a little over one hour per week are more likely to develop new relationships via social media.*

*Putnam Social Advisor Survey, 2023.

Putnam's team of dedicated Practice Management Specialists can help you optimize your use of social media.

Alexandra Nawoichik

Senior Practice Management Specialist

Marie Sparks

Senior Practice Management Specialist

Tiffany Dyson

Practice Management Specialist

Learn how to:

Develop and express your professional brand to grow and maintain relationships

Connect with current clients; attract top prospects; leverage groups

Align marketing communications with target markets

Prospect and generate revenue using social media

Mine for high-quality referrals and strengthen relationships with the households you serve

Increase net new assets with a premium subscription

Add value with clients and nurture COIs with unique seminars

Empower those in life transition

Educate local business owners