As year-end approaches, many individuals are considering making charitable donations.

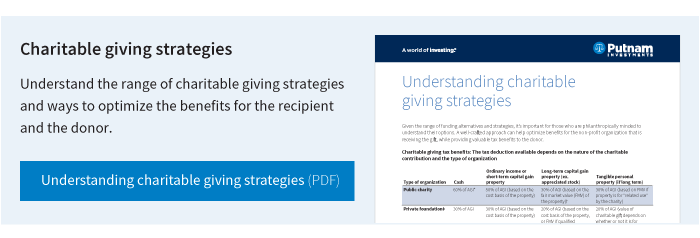

With the range of funding alternatives and strategies, it’s important for donors to understand their options.

A well-crafted approach can help optimize benefits for the non-profit organization that is receiving the gift while providing valuable tax benefits to the donor.

The tax deduction available depends on the nature of the contribution and the type of organization.

For a detailed comparison of charitable giving options, explore our investor education piece, “Understanding charitable giving strategies.”

Here are four strategies to consider:

Qualified charitable distributions. A provision of the tax code allows a tax-free distribution from an IRA if transferred directly to a qualified, public charity (donor advised funds, charitable trusts, and private foundations are not eligible). To learn more about this strategy read our investor education piece, “Donating IRA assets to charity.”

Donor advised funds. These allow a donor to make tax-deductible contributions into a fund with the flexibility of requesting grants to charities over time. These funds are generally managed by a third-party organization with the potential for investment growth over time.

Private foundation. This may allow a family to create a legacy of philanthropy over multiple generations while maintaining control over funding, investment management, grant making, operations, and administration. A foundation may provide significant income and estate tax savings depending on the size of the endowment. However, foundations can be costly and complex to administer.

Charitable trusts. These are known as “split interest” gifts since they provide benefits to the charity and the donor (or their beneficiaries). The amount of the charitable gift for tax deduction purposes will depend on the term structure of the trust and current interest rates.

The importance of expert advice

It’s important for investors to work with a tax professional or financial professional with knowledge of their personal financial situations. They can advise investors on whether these strategies could benefit an overall tax plan to take advantage of these strategies. As we approach year-end, it will be important to consider these types of deductions.

327958

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.