One of the key challenges with our retirement system is that a significant portion of workers do not have access to a retirement savings program through their employer.

According to the AARP, nearly half of workers are not covered by a workplace plan (AARP 2022 Report).

In the past there have been several attempts to address this issue at the federal level, with proposals to adopt an “Auto IRA” program requiring businesses (with certain exceptions) to at least offer a payroll deduction IRA program for employees. As far back as 2006, an Automatic IRA Act was introduced to increase coverage and retirement account participation. However, the legislation did not advance in Congress.

When progress was not made at the federal level, states began to take the initiative on their own.

In recent years, many state governments have taken steps mandating that business owners who do not offer a plan establish a retirement program for employees or face penalties. Oregon was the first to launch a program in 2017, with OregonSaves.

A number of states have established programs that are not mandates, but are voluntary. For more details on specific states, see "State Programs 2024."

Citing the emergence of many state programs, a new federal auto-IRA proposal was introduced in the House just last week. The Automatic IRA Act of 2024 (H.R.7293) would require employees to be automatically enrolled in either an IRA or some other “automatic contribution plan or arrangement,” like a 401(k). It would apply to businesses with 10 or more employees, for plan years beginning after 2026.

New initiatives could drive plan growth

Lawmakers and the retirement industry have tried for years to close the access gap. This year could see growth in workplace plans. The growing number of state initiatives and new tax incentives introduced by recent legislation, including SECURE 2.0, could move the dial on business startup plans.

For business owners potentially subject to a state mandate, now is an excellent time to consider establishing their own plan.

Common characteristics of state-mandated retirement programs

- After-tax contributions are made via payroll deduction into a Roth IRA

- May require auto-enrollment of employees at a minimum contribution rate (employees can opt out of participating)

- These IRA-based savings programs generally lack the features and benefits of a qualified retirement plan, such as a 401(k)

- Generally do not offer employer contributions

- Employers not meeting requirements of participating in a state-mandated plan will typically face a penalty per employee (for e.g. in California there may be a fine of up to $500 per employee)

- Depending on the state, there may be exceptions to the mandate based on the number of employees and other factors such as how long the business has been operating

Opportunity for smaller business owners to establish retirement plans now

There are valuable tax incentives available for employers to establish new private sector retirement plans.

For business owners potentially subject to a state mandate, now is an opportune time to consider establishing their own plan.

By designing their plan, business owners may customize the plan to meet their particular needs and objectives. That could include maximizing contributions for key owners/partners, features for attracting and retaining talent, or through vesting provisions to address turnover concerns.

Here are some details about the SECURE 2.0 tax incentives

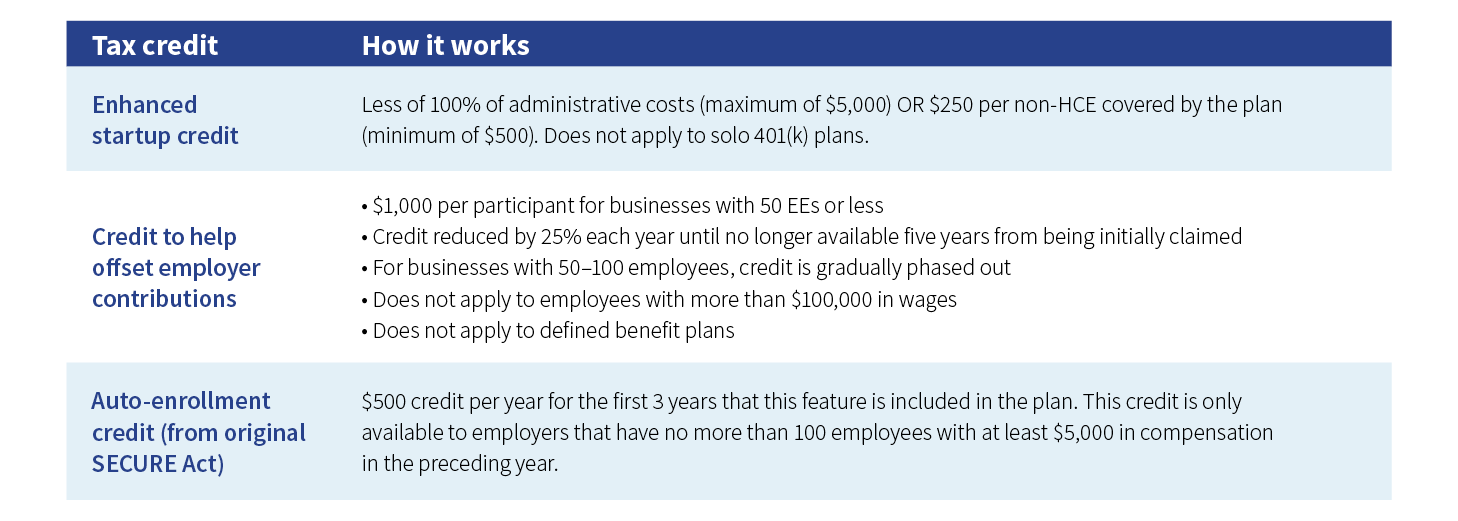

- Enhanced tax credit to establish a new plan (including a SEP IRA or a SIMPLE IRA) – up to $5,000/year tax credit to offset startup and administrative costs for the first three years of operation

- Additional tax credits (depending on circumstances) to help offset employer contributions or as an incentive to implement auto-enrollment in the plan

Tax credits available to small-business owners

336383

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.