Taxes are typically top of mind for investors, especially when the focus turns to updating tax plans for the year ahead.

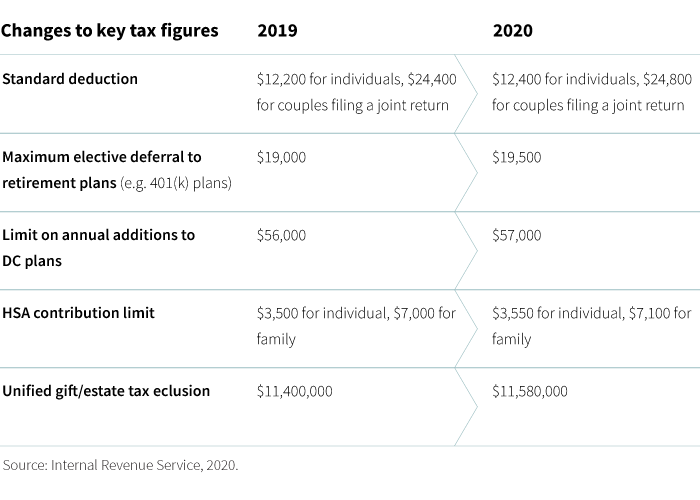

The Internal Revenue Service recently announced the tax rates and contribution limits for 2020. Most of the changes to tax figures resulted from inflation adjustments. Some changes were implemented due to the passage of the SECURE Act (Setting Every Community Up for Retirement Act of 2019) in December. For more information about changes to the kiddie tax as a result of the SECURE Act, read the blog , “The kiddie tax changes, again.”

Know your bracket

A first step for investors in tax planning for the coming year is to determine their tax bracket. Putnam’s “2020 tax rates, schedules, and contribution limits” can be a useful reference to review with a financial advisor.

While most of the numbers are unchanged, among retirement savings accounts, contribution limits have increased. These include the maximum contribution level allowed for workplace retirement plans, including 401(k) plans. Also, investors will be able to add more to their health savings accounts starting in 2020.

Tax plans may need an update

The SECURE Act represented the most significant changes to the nation’s retirement system since passage of the Pension Protection Act of 2006. Many of the provisions are being implemented in January. Among many updates, the law increases the age for required minimum distributions from retirement accounts and repeals the age limit for making traditional IRA contributions.

Planning considerations

- Review retirement plan contributions. If an investor is maxing out 401(k) contributions for 2019, they may want to consider deferring additional funds to max out for 2020. Investors may also want to take advantage of the tax benefit of increasing contributions to a health savings account.

- Plan for deductions. With the increase in the standard deduction, investors should plan accordingly. If possible, consider maximizing deductions into one tax year when itemizing. For example, "lumping" charitable tax deductions into one year may provide an advantage for investors wishing to itemize.

319823

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.