While markets have experienced tremendous volatility since the COVID-19 crisis emerged, there are certain financial planning opportunities that some clients may wish to consider.

In particular, lower asset values combined with historically low interest rates may favor certain wealth transfer strategies.

Current market conditions may make a grantor retained annuity trust (GRAT) more attractive.

Tax advantages of a GRAT

Many high-net-worth families use GRATs to transfer assets to heirs.

- The “zeroed out” GRAT strategy, if structured properly, can transfer wealth to heirs free of federal gift and estate taxes.

- A GRAT can be funded with a wide range of investments and is typically established for a term of two to five years. During that time, annuity payments are made from the trust to the grantor — not the beneficiary — until the principal plus an assumed interest rate have exhausted the trust.

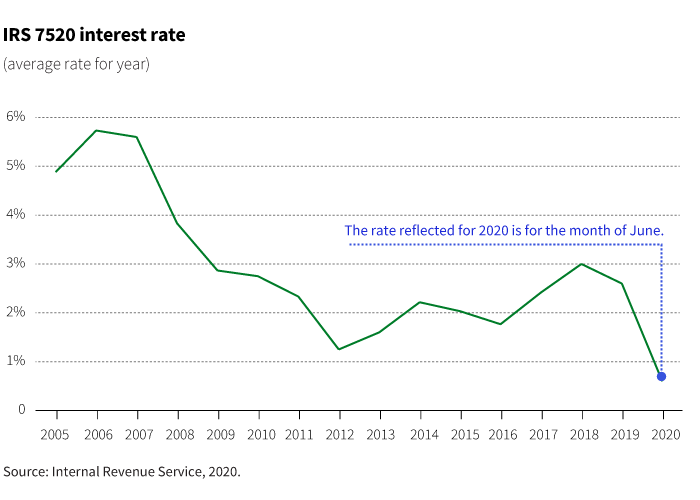

- The assumed interest rate is specified by the IRS under Section 7520. Any income the trust earns above the 7520 rate is called “remainder interest” and is passed on to the beneficiary free from gift or estate taxes.

- A low IRS 7520 rate can make the GRAT strategy more appealing.

- The IRS began publishing this interest rate monthly beginning in May 1989; it debuted at 11.6%. The most recent published 7520 rate for June 2020 is 0.6% — the lowest in its history.

Zeroed out GRAT strategy

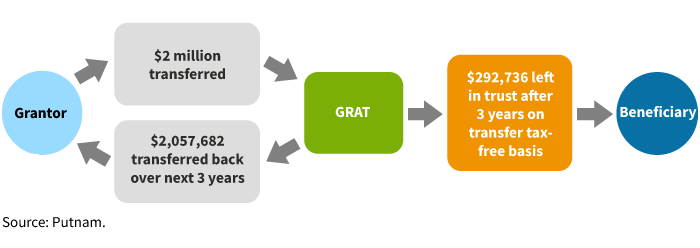

The following example illustrates how a GRAT strategy may result in a transfer of assets that is free of gift and estate taxes.

- The grantor transfers $2 million of assets (for example, stock, real estate, business interests) into an irrevocable grantor trust.

- The trust transfers a certain value of that property back to the grantor over the three-year term based on an annuity factor calculated using the IRS 7520 interest rate (0.6% as of June 2020).

- In the example below, if trust assets grow 8% annually, nearly $300,000 remains in the trust free of gift and estate taxes for the benefit of the grantor’s heirs.

Note: The grantor must outlive the term of the GRAT in order for this strategy to work successfully.

Estate planning expertise

Individuals need to consult with a qualified estate planning or tax attorney when considering transferring assets into a GRAT. While lower interest rates may present a window of opportunity, it is important to speak with an advisor before deciding to incorporate a trust or other strategy into a financial plan.

321993

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.