As lawmakers consider options to generate revenue, several tax proposals could resurface this year that impact how investors transfer wealth.

Under the current tax system, certain appreciated assets benefit from stepped-up cost basis treatment at death — meaning that the cost basis of property passing to heirs is based on the fair market value at death.*

For example:

- Bob purchases a stock at a price of $10 per share

- At Bob’s death, the stock price has appreciated to $100 per share

- Bob’s son John inherits the stock with a cost basis of $100 per share

- The amount of appreciation in the price of the stock ($90 per share) escapes capital gains taxation

Because of this benefit, some investors choose to hold appreciated stock until death rather than selling or gifting highly appreciated stock to family members while living. When property is gifted to family members for instance, carryover basis generally applies, negating the benefit of stepped-up cost basis at death.

In recent years, certain lawmakers in Congress have viewed stepped-up cost basis treatment at death as a technique for higher-net-worth families to unfairly transfer wealth to heirs free of taxes. These discussions may gain momentum as policy makers consider options to raise federal government revenue to offset desired spending programs such as infrastructure or health-care initiatives.

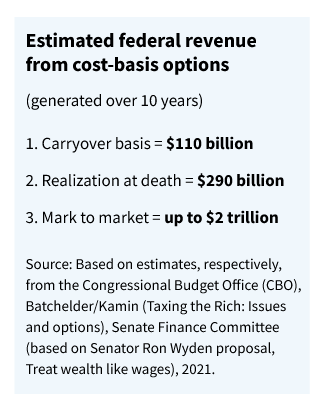

Here are three potential proposals that could curb stepped-up cost basis treatment of property at death.

1. Carryover basis treatment

- The same treatment that applies to transferred gifts while living would apply to assets passed at death

- Heirs inherit the original (adjusted) cost basis of the property, instead of benefiting from stepped-up cost basis based on the fair market value of the property at death

- When property is sold, taxes on capital gains are triggered

- Provision would be consistent with current tax policy on gift transfers but may not raise enough desired revenue for policy makers

- May allow heirs some planning flexibility in timing tax liability since taxes are not triggered until the property is sold

- Would require tracking of original cost basis, which may be problematic for some illiquid assets such as real estate held within a family for many years

2. Capital gain realization at death

- This approach would tax unrealized gains at death, regardless of whether the property is sold or not, reducing the incentive to hold appreciated assets until death

- A tax realization event at death would generate more immediate revenue for the federal government than applying carryover basis treatment (option #1)

- May present liquidity challenges for estates and heirs who face a tax bill on illiquid assets that are not readily tradeable. The provision would likely necessitate certain exclusions (certain amount of the value of family farms, for example)

- May force heirs to liquidate certain inherited assets to pay taxes

3. Accrual or “mark to market” treatment

- Assets would be taxed based on change in value each year, allowing the federal government to regularly tax property regardless if a sale or death occurs

- Depending on the structure, this could raise significant revenue but would result in higher compliance costs for taxpayers and an increased enforcement burden for the IRS

- There is a challenge in valuing illiquid, non-tradeable assets (shares of closely-held businesses, for example) annually that may necessitate a “look-back charge.” This treatment would allow for deferral of taxes until the sale of non-tradeable property, with an added interest charge or surtax to mitigate the benefit of deferral

- This proposal would reduce the incentive of holding certain property solely due to tax considerations. It would also cause liquidity concerns for some taxpayers faced with an annual tax bill on appreciated assets

- A current proposal (“Treat Wealth Like Wages”) introduced by Senator Wyden (D-OR), applies this “mark to market” treatment only to taxpayers with income of $1 million or more and at least $10 million in net assets. There are certain exemptions for residences, family farms, and retirement accounts

- Other administrative challenges exist, such as the treatment of unrealized, capital losses and whether an immediate deduction would apply

Tax increase discussions on the agenda this year

As Democratic lawmakers pursue major legislative goals, such as infrastructure spending, tax increases will be discussed as a means for offsetting some of the cost. Given the amount of wealth transferred to heirs free of capital gains taxation, step-up in cost basis is garnering attention from Democratic lawmakers as a potential source of revenue. However, because a large portion of wealth is held outside of regularly traded and valued property such as stocks, the administration of some of these proposals would be very challenging. Whether or not taxation on wealth transferred at death will change, taxpayers should understand the current tax benefits of step-up in cost basis at death, while also following current developments in the event that estate plans need to be adjusted. For a deeper understanding of step-up in cost basis and other estate planning rules, read Putnam’s investor education piece, “A closer look at the current estate and gifting tax rules.”

*Certain property, such as retirement accounts and annuities, is considered Income in Respect of a Decedent (IRD) property and does not receive stepped-up cost basis treatment at death.

325378

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.