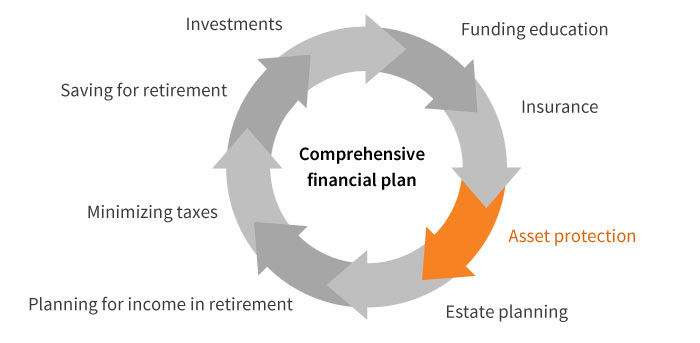

Building wealth is an important foundation of financial planning. But another important piece of a comprehensive financial plan is protecting assets from lawsuits or other legal claims with asset protection strategies.

What is asset protection?

An asset protection strategy should be part of any financial plan. Individuals who have built up sizable retirement savings and established equity in their homes should consider ways to protect hard-earned assets from a lawsuit, civil claims, or bankruptcy proceedings.

Asset protection is often associated with high-net-worth individuals, business owners, and professionals such as doctors, who are considered at high risk of being litigation targets. But people with modest financial assets, such as a home, investments, and retirement savings, also have reason to consider their own plans. Claims and lawsuits stemming from car accidents, personal injury on your property, and liabilities involving family members can place these assets at risk. Importantly, asset protection is not about defrauding creditors, but utilizing legal protections available to reduce the risk that assets are exposed as a result of an unforeseen creditor event.

Asset protection is a critical part of a financial plan

Put a plan in place BEFORE something happens

For many people, asset protection is an afterthought or not considered at all. It is important to shield assets before something happens. Once an event like a lawsuit occurs, it’s very difficult or maybe impossible to protect property from potential creditors if a comprehensive plan is not already in place.

Asset protection can help you maintain your standard of living and preserve your ability to pass assets to heirs or charities. Although no fail-safe plan exists, asset protection often incorporates a combination of different steps, including basic and more complex strategies. With a few practical steps, many individuals can protect assets from potential creditors.

Making sure the basics are covered

Save in retirement plans

Retirement savings receive protection from creditors under federal and/or state law. The level of protection will vary depending on the type of account and other factors. For example, workplace retirement plans such as 401(k), profit sharing, and defined benefit pension are fully protected from creditors under federal law (i.e., ERISA).* While there may be limits under federal law with respect to IRAs, under many state laws, IRAs are fully protected from creditors.

Review homeowners and auto insurance policies

Make sure that liability coverage amounts on home and auto policies are adequate. Consider increasing the amount since the cost of additional liability coverage is usually reasonably priced.

Purchase an umbrella liability insurance policy

Umbrella liability policies provide additional coverage in excess of auto and home policies, starting at $1 million worth of coverage. The cost of coverage is generally reasonable and can provide protection if there is a creditor claim in excess of liability coverage on home and auto policies. Umbrella policies require policyholders to maintain a certain minimum amount of liability coverage on auto and home policies, typically $250,000 on auto and $300,000 on home, but these limits will vary depending on the insurance carrier and policy. See "Investors should consider umbrella insurance when crafting a financial plan."

Take advantage of homestead exemptions

Depending on the state, a homestead exemption can protect equity owned in a primary residence from a creditor’s claim. The level of protection usually depends on the length of ownership, and in most states, there are caps on the amount of equity that can be protected. While some states automatically apply protection to your home, in other states, a legal filing is necessary to designate your primary residence as a homestead. Additional limits may apply in the case of a federal bankruptcy proceeding.†

Fund college savings plans

Federal bankruptcy law provides protection on contributions into 529 college savings plans depending on circumstances (e.g., How long were funds contributed to the plan before bankruptcy?). Additionally, certain states provide protection under state law.

Consider life insurance or annuities

Some states will protect funds held within life insurance and annuities from creditors. The level of protection will vary by state law depending on specific circumstances.

Seek professional guidance

Establishing an asset protection plan is crucial for helping to ensure your standard of living can weather any storm, and position you to pass assets to heirs or charitable organizations. Those with more complex needs may want to consider more advanced asset protection techniques such as the use of spendthrift provisions in trusts, Domestic Asset Protection Trusts (DAPTs), or forms of business ownership such as Limited Liability Companies (LLCs). It is important to consult with a tax or legal professional with experience in these types of strategies and who understands specific state laws. For more details on specific strategies, see our “Asset Protection Checklist” can help individuals get started on developing a plan.

*Retirement account funds held in or previously transferred from an ERISA employer-sponsored plan (401(k), for example) receive full protection under federal bankruptcy law. Funds held in contributory IRAs are protected up to $1 million under federal bankruptcy law, indexed for inflation ($1,512,350 as of 2023). Note that retirement account assets (qualified plans and IRAs) may be subject to attachment by the IRS in the case of a tax levy.

†Federal bankruptcy law limits protection to $125,000* for property acquired within 1,215 days of bankruptcy filing. This figure is updated for inflation under U.S. Bankruptcy code 522(p). For 2023, the maximum homestead exemption under federal bankruptcy for those acquiring the property within 1,215 days of filing is $189,050.

334771

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.