For individuals planning to take a deduction or use a required minimum distribution (RMD) for charitable donations, a deadline is approaching.

It’s particularly important to review charitable gift plans as donations must be completed by the end of the year to claim an income tax deduction for 2023. In addition, those planning to take an RMD before the end of the year may consider making a qualified charitable distribution (QCD). This IRA provision allows individuals to avoid taxable income arising from an RMD and make a charitable donation at the same time. For more details see “Donating IRA assets to charity.”

By reviewing plans now, there is still time to make changes to a giving strategy for 2023. There are several considerations that taxpayers may act on at the end of the year to make the most of their charitable giving, including making larger gifts.

Here are some key questions when reviewing charitable giving plans:

- Are you planning to itemize deductions on your 2023 tax return? If so, making additional charitable gifts before the end of the year can further reduce taxable income.

- How large of a charitable gift is being considered? A significant charitable contribution may allow a taxpayer to itemize deductions. For 2023, the standard deduction for single filers is $13,850, and $27,700 for married couples filing a joint tax return (those age 65 or older, or blind, are eligible for a slightly larger standard deduction). Taxpayers would claim the standard deduction unless the total of their (below the line) tax deductions exceed the standard deduction.

- Are you at least age 70½ and NOT planning on itemizing deductions? If you are not itemizing deductions and are interested in giving to a charity, a QCD would generally make sense since it allows the distribution of tax-deferred IRA funds at a 0% tax rate.

Choosing the right strategy is key

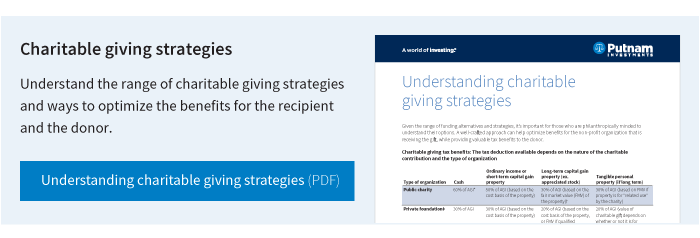

Given the range of funding alternatives, strategies, and different rules for charitable giving, it’s important for those who are philanthropically minded to understand their options. A well-crafted approach can help optimize benefits for the nonprofit organization that is receiving the gift, while providing valuable tax benefits to the donor.

Depending on the type of type of property being donated and the recipient charity, limits on the tax deduction will vary. For more details see “Understanding charitable giving strategies.”

Importance of expert advice

It’s important for individuals to work with a tax professional or financial professional who has expertise in charitable planning and knowledge of their personal financial situation.

335686

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.