- Europe is making strides as Germany drops its resistance to fiscal burden sharing.

- A proposed €750 billion recovery plan will be a powerful tool for managing the region’s economy.

- Some countries, including France and Germany, are showing a few early signs of recovery.

Italy and Spain are leading calls among the countries most affected by the coronavirus pandemic for more help from the European Union (EU). They argue it is time to revisit a eurozone-wide fiscal mechanism with joint borrowing. Amid signs of rising hostility in Italy against the EU, German Chancellor Angela Merkel and French President Emmanuel Macron — in what some have claimed is a breakthrough — proposed establishing a €500 billion recovery fund. This initiative would involve the issuance of common debt and is no doubt a significant change for the region.

Germany is relaxing its fiscal hold

The proposed fund would be funded by the EU budget. The European Commission will borrow these funds and then disburse them via the European budget. The relief fund would create a new liability for Germany, which it had previously resisted. Germany has decided the threat to the cohesion of the eurozone is large enough that it has to move decisively. Therefore, this is a step forward. Still, it remains unclear how large a move this is and how closely it will come to be the kind of common fiscal policy mechanism that analysts have long claimed is essential.

Germany has decided the threat to the cohesion of the eurozone is large enough that it has to move decisively.

First, this is technically only a proposal from Germany and France. The European Commission, the bloc’s executive branch, plans to add an additional €250 billion in loans aimed at lifting the region from its economic slump. The remaining members of the “frugal five,” now the “frugal four” (Netherlands, Austria, Finland, and Sweden) are unhappy and are preparing a counterproposal. However, France and Germany are the most important countries in the EU, and they usually get their way. Still, nothing will be concrete until it has been approved by all EU countries at a meeting expected in July. The details of the mix of loans and grants, and how much money each country will receive, will have to be agreed.

The experience with the EU is that these things don’t get resolved quickly. This is because it involves the EU budget, where discussions were already proving extremely difficult. Part of the reason is because of Britain’s withdrawal from the EU and the consequent loss of its budget contributions. Therefore, it will take a while to nail down all the details of the recovery plan. As always with these things, the details matter.

Opening the door for more stimulus

Secondly, the size of the new fund, once it is agreed, matters. Italy’s main problem is its size, debt load, and long history of extremely slow growth. Even generous terms on new EU funding won’t help Italy unless the amount of easy money is large. In addition, it is not clear that northern Europe’s taxpayers are prepared to support Italy on the scale that would make a real difference to the country’s debt dynamics.

It is important, however, to note that a door, previously closed, has now been opened.

It is important, however, to note that a door, previously closed, has now been opened. In the EU, once a principle has been conceded, it never returns. So, this mechanism — even though it has been designed with this particular problem in mind — is a powerful new tool for managing the region’s economy. The new initiative and the European Central Bank’s (ECB) generous quantitative easing program shifts the risk profile of the euroland periphery countries.

The key risk remains Italian politics. If the current government falls, and Matteo Salvini’s League party comes to power, it is possible Italy would begin to flout the eurozone’s fiscal rules and dare the ECB to stop buying Italian bonds. At some point in the future, persistent slow growth could force even a moderate Italian government into this position. But the likelihood of this happening in the near term has fallen substantially because of Germany’s concession on debt being financed through the EU budget.

Some green shoots

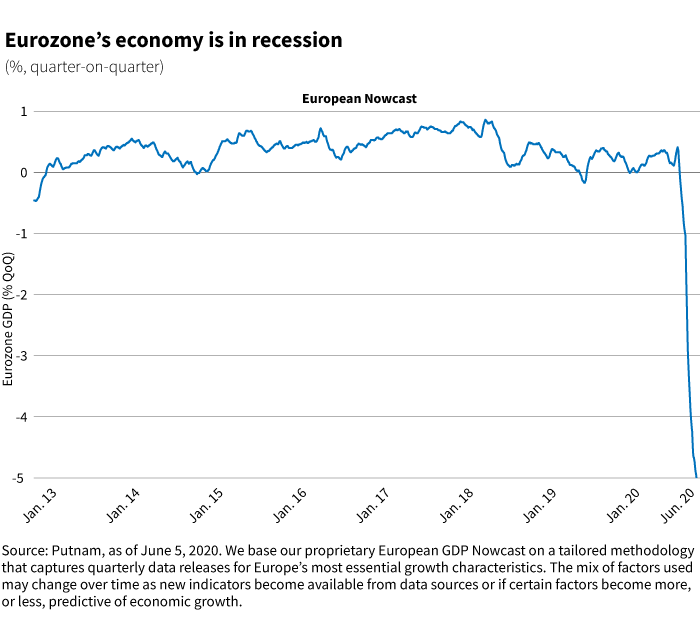

Cyclically, the eurozone looks to be in a decent place. There are some clear signs of recovery in many countries. Germany has just agreed to a decent fiscal package to help the economy recover. There are also some encouraging signs in Italy and France. Spain, however, is lagging quite badly. Although no one is out of the woods yet, recoveries are slowly underway.

The ECB is also doing its bit to help, with an expansion of its QE program and confirmation that the program will continue at least until June 2021. In early June, the central bank said it will increase its Pandemic Emergency Purchase Program by €600 billion. That comes on top of €750 billion of government bond purchases announced in March. These steps are more aggressive than expected, and while they are not game changers, they are helpful.

322111

For informational purposes only. Not an investment recommendation.

This material is provided for limited purposes. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument, or any Putnam product or strategy. References to specific asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations or investment advice. The opinions expressed in this article represent the current, good-faith views of the author(s) at the time of publication. The views are provided for informational purposes only and are subject to change. This material does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon. Investors should consult a financial advisor for advice suited to their individual financial needs. Putnam Investments cannot guarantee the accuracy or completeness of any statements or data contained in the article. Predictions, opinions, and other information contained in this article are subject to change. Any forward-looking statements speak only as of the date they are made, and Putnam assumes no duty to update them. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties. Actual results could differ materially from those anticipated. Past performance is not a guarantee of future results. As with any investment, there is a potential for profit as well as the possibility of loss.

Diversification does not guarantee a profit or ensure against loss. It is possible to lose money in a diversified portfolio.

Consider these risks before investing: International investing involves certain risks, such as currency fluctuations, economic instability, and political developments. Investments in small and/or midsize companies increase the risk of greater price fluctuations. Bond investments are subject to interest-rate risk, which means the prices of the fund’s bond investments are likely to fall if interest rates rise. Bond investments also are subject to credit risk, which is the risk that the issuer of the bond may default on payment of interest or principal. Interest-rate risk is generally greater for longer-term bonds, and credit risk is generally greater for below-investment-grade bonds, which may be considered speculative. Unlike bonds, funds that invest in bonds have ongoing fees and expenses. Lower-rated bonds may offer higher yields in return for more risk. Funds that invest in government securities are not guaranteed. Mortgage-backed securities are subject to prepayment risk. Commodities involve the risks of changes in market, political, regulatory, and natural conditions. You can lose money by investing in a mutual fund.

Putnam Retail Management.