Updated July 2, 2020:

On July 1, 2020, Congress passed a bill to extend the deadline for accepting PPP loan applications to August 8, 2020.

There is still funding available for small-business loans under the Paycheck Protection Program (PPP), but the deadline for applications is fast approaching.

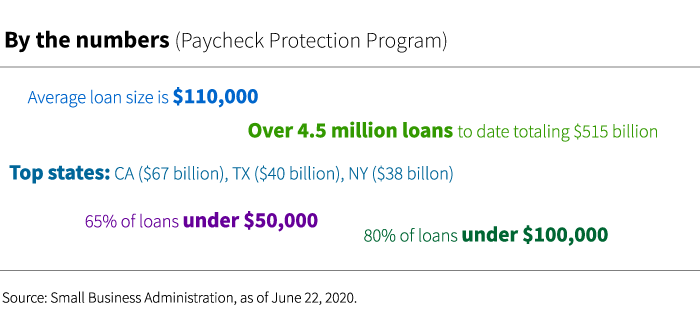

Small businesses impacted by lockdown efforts to contain the coronavirus pandemic have until June 30, 2020 to apply for a loan from the popular program. After two rounds of federal funding totaling more than $600 billion, some $120 billion remains available, according to the Small Business Administration (SBA).

The program was launched to help small businesses cover payroll, rent, and other expenses during the pandemic. A key feature of the program is its loan forgiveness provision. If certain requirements are met, the loan can essentially become a tax-free grant.

More businesses may benefit

With recent changes to the rules to meet the loan forgiveness requirements, more businesses may be able to take advantage of the provision. See our recent post on the latest requirements.

Some of the highlights:

- Among the amended rules, there is now an option to use a 24-week period to track expenses following receipt of the loan. For example, many business owners did not pursue the loans, which originally required an eight-week reporting period. Some businesses were shut down in the early part of the pandemic (hair salons, retail stores). Applicants need to have payroll-related costs to benefit from forgiveness. With a longer reporting period, more businesses may be able to pursue the forgiveness provision.

- When calculating the amount eligible for forgiveness, at least 60% of those expenses must be payroll-related (reduced from 75%). This change may help businesses that have lower payroll costs as a percentage of total business expenses and/or those who operate in areas with higher non-payroll costs such as rent.

Making the calculation

The SBA released a new online tool, “Lender Match,” designed to help interested small-business applicants that may not have a relationship with a lender. By entering some information about the business online, business owners can be connected with SBA-approved CDFIs (Community Development Financial Institution) and other small lenders.

The free tool allows business owners to:

- Answer several questions about the business

- Get matched to a SBA-qualified lender in two days

- Talk to lenders to discuss terms

- Apply for a loan

Given the looming deadline, those interested in the PPP loans need to act quickly. Business owners need to contact an advisor, tax professional, or lending expert.

322273

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.