The House spending package continues to evolve as Congress debates provisions around spending and taxes. The multi-trillion dollar proposal includes support for social service programs, health care, and green energy provisions.

Although not included in the initial proposal, lawmakers from higher-taxed states are negotiating some relief, at least temporarily, from the $10,000 cap on deducting state and local taxes (SALT). Recent conversations suggest that there may be a good chance SALT relief will be included in final legislation. Taxpayers from higher-tax areas should monitor these negotiations and consider planning strategies to maximize deductions.

Planning considerations for maximizing the SALT deduction

A number of proposed changes have been considered this year including a short-term repeal, doubling of the cap, and other variations. If there is some action, taxpayers may wish to defer deductions into next year to maximize use of the deduction.

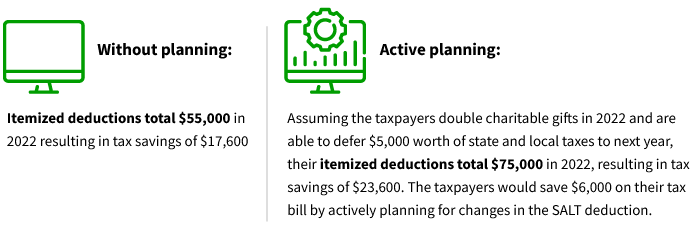

Consider this example of a married couple with high state and local taxes.

- Assume Congress repeals the SALT cap for 2022 but limits it to those with income less than $400,000

- Annual deductions: $20,000 real estate taxes, $20,000 state income taxes, $15,000 charity

- Assume 32% marginal tax bracket

With a $10,000 cap on deducting SALT these taxpayers would claim the standard deduction this year, which would be higher than the total of their itemized deductions in this example ($10,000 limit on SALT + $15,000 in charitable gifts for a total of $25,000). For 2021 the standard deduction for a married couple filing a joint tax return is $25,100. If there is some relief from the SALT cap for 2022 some taxpayers may benefit from deferring deductions into next year. For example:

- Make no charitable gifts in 2021, double up in 2022 instead

- Push portion of quarterly estimated state income taxes and/or real estate tax payment into 2022 if possible

Keeping an eye on Congress

The House is scheduled to vote on the bipartisan infrastructure bill by the end of the month, that could be combined with a vote on the spending package. If that happens, more details will be released on provisions that made it into the final bill. In the meantime, taxpayers should consult with their tax professional on a strategy for optimizing tax deductions on their returns.

327767

For informational purposes only. Not an investment recommendation.

This information is not meant as tax or legal advice. Please consult with the appropriate tax or legal professional regarding your particular circumstances before making any investment decisions. Putnam does not provide tax or legal advice.